Articles

The good thing about free online slots is that you can is actually aside position video game with no exposure. They also leave you a good effect of your own video game designer and regularly the new playing site. You can fuss and get online slots one to best suit your requirements. The game auto mechanics in the online position online game are identical to genuine, the only difference is that you may’t winnings a real income.

Which If you do?: free slots uk heart of the jungle

You’re produced for the position diet plan and start to try out by the simply clicking the fresh Twist key. You will need to ensure that the internet casino works less than a legitimate gaming license granted by the a reliable regulatory organization. BonusFinder.com try a person-driven and separate local casino comment site.

Free Push Gambling Slots

Free online slots took off because you not any longer have to attend the brand new part from a gambling establishment rotating the brand new reels. One other reason why this type of gambling enterprise online game is indeed preferred on the net is as a result of the versatile set of designs and you may layouts that you could talk about. Spread signs also are popular feature out of slot players, very most slot machine game titles ability them. Including, inside our Enchanted Orbs game, obtaining around three scatters lets you choose from an excellent revolves bonus otherwise Wonders Orb Respins, which honor larger winnings. Videos ports in addition to their online competitors explore technical to provide more complex game play than an elementary slot machine game. This consists of implies to own icons to carry over across spins, in addition to unique cycles and you may incentives.

Mobile software come with numerous distinctive line of advantages, including enhanced associations and you may functionality. Volatility is a phrase used to measure the danger of shedding a gamble. Higher volatility ports would be the riskiest but provide free slots uk heart of the jungle big victories, that have volatility condition signaling just how big or small you can expect the gains becoming. As the a free of charge-to-play software, you’ll explore an in-video game money, G-Coins, that may simply be useful for playing. In the 2 hundred 100 percent free spins on your greeting incentive, so you can unique transformation and you will freebies in addition to awards to own completing mini-video game. We’re also more than just a totally free gambling establishment; we’re an exciting online community where family collaborate to express its passion for social gambling.

All of us from online game benefits provides cautiously designed within the-depth ratings of the many harbors you can expect. Not only can you find out featuring a slot provides to provide, however, all of us will also let you know their sincere view from the online game. You could potentially gamble Sweepstakes at no cost, or you can play to attempt to victory honours, and get those individuals honors for money.

Real cash Slots

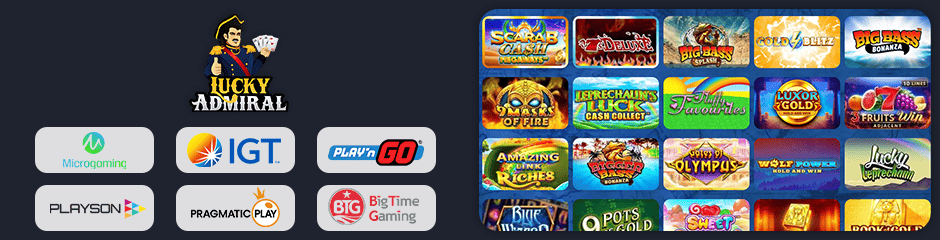

The prosperity of such servers prompted the brand to visit personal and go into most other streams of the gaming community. IGT could free zero expenses with regards to leasing the brand new legal rights to have video, bands, and television shows. As a result, they’ve assembled specific fairly amazing harbors, such as Jeopardy, Monopoly, Cluedo, and you will, of course, Controls out of Fortune. A combination of symbols that make it you are able to so you can win a good honor. In addition to that, however you acquired’t need to worry about becoming bombarded that have pop-ups or other advertisements any time you gamble. You’ll discover and that video game our very own advantages like, as well as which ones we believe you will want to avoid from the all can cost you.

You could spin the newest reels and you may access the new game’s incentive has 100% 100percent free risk-free. When you gamble free ports from the an internet casino, you’ll always be provided with some virtual loans to have the online game. You might twist as you perform if you were to play for real money. The brand new 100 percent free models of your own games come with yet game play mechanisms and you will special features as the real cash types.

This gives a chance to enjoy loads of the fresh online game, of next the newest suppliers. There are some choices certainly one of ‘Popular Filters’, and casinos you to definitely assistance mobiles, alive agent gambling enterprises, or crypto websites. You can also personalize your search based on and therefore fee procedures you would like (PayPal, Skrill, Paysafe, etc.). While you are a fan of the newest vintage position fresh fruit theme and you will effortless gameplay, Sizzling hot Deluxe away from Novomatic will be a good option for your. A casino slot games setting enabling the overall game to twist automatically, instead your in need of the fresh press the new spin button.

This type of themes put breadth and thrill every single games, transporting participants to several planets, eras, and you can fantastical areas. Let’s look into the different globes you could potentially discuss as a result of these types of enjoyable position templates. Free trial ports is actually fun and simple to play, so the laws they arrive having aren’t you to definitely requiring. Everything you need to manage will be conscious of the brand new paylines and you can icons, in order to know what to anticipate out of certain combinations.

Sure, online slots is set up having inspiration away from antique, land-centered slots. The newest 100 percent free slot machines that have totally free revolves zero obtain necessary are all gambling games models for example videos pokies, vintage pokies, 3d, and you can good fresh fruit servers. The newest free ports 2025 provide the newest demos releases, the new gambling games and you can totally free ports 2025 which have totally free revolves. 100 percent free slots no down load games available whenever with a connection to the internet, no Current email address, no subscription info wanted to obtain access. After logged inside the, get an instant play by pressing the newest free spin switch to initiate a game title training.