Posts

- Reel bonanza slot machine real money: The new Ports for the High RTP

- Do Spend By Cell phone Casinos Costs People Charges For Deposits? Shell out from the Cellular telephone Roulette

- William Hill promo password Can get 2025: Fool around with T60 to find £60 in the free bets

- Do you know the most recent trend of online slots games?

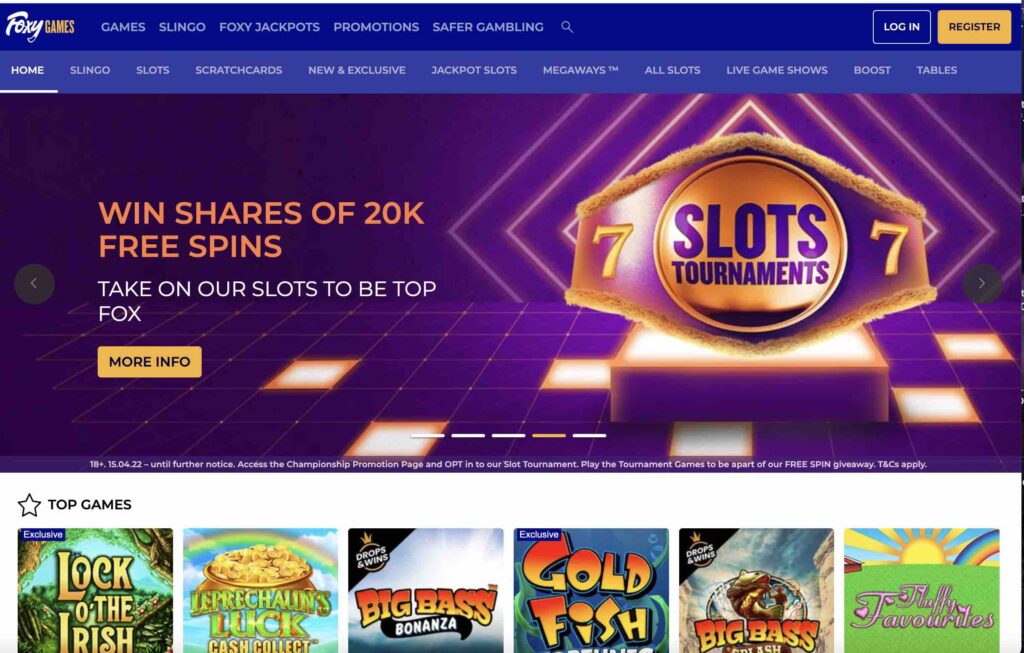

We’ve created it directory of a knowledgeable cellular ports you can wager free otherwise real cash during the British gambling enterprise applications. When deciding on and that internet sites and you can casino software in order to suggest to United kingdom professionals, all of our SlotsWise local casino professionals capture many different points on the consideration. Our very own cautious opinion techniques ensures i merely ever before recommend ab muscles better harbors application in order to win a real income.

Reel bonanza slot machine real money: The new Ports for the High RTP

There are also standard encoding steps utilized by most websites for example that it, and faithful security features used by large gaming networks. Such, an reel bonanza slot machine real money excellent 200% matched up very first deposit extra will provide you with an additional 100% of your deposit while the put added bonus fund. These types of bonuses effortlessly make you extra earliest deposit extra currency you to you can use next to your own genuine finance, allowing you to get some 100 percent free revolves to the 100 percent free cash.

In addition to harbors, you’ll along with see a good number of classic dining table game such Black-jack, Roulette, Baccarat, Casino poker and a lot more. Once more, like any pay-by-cellular options, the newest put limits are on the lower front side, therefore it is great to have everyday professionals, however an option to the big spenders available. Moreover it is’t be used to own withdrawals, which is other restrict you need to recall.

Do Spend By Cell phone Casinos Costs People Charges For Deposits? Shell out from the Cellular telephone Roulette

Boku works best for both prepaid and you may package mobile users which is 100 % as well as reputable. Withdrawing from your account is fast and you will demands is actually canned the new exact same go out. From the Play United kingdom, we satisfaction ourselves within the taking finest-level mobile casino games for United kingdom professionals. Our purpose centered mobile program works with all major cell phones and you can tablets. Our hd games are formatted to own well-known systems for example apple’s ios, Android os, Screen and Blackberry.

William Hill promo password Can get 2025: Fool around with T60 to find £60 in the free bets

Thus, any kind of your own betting design and you may funds, this site has some of your own greatest harbors and you may internet sites to get you started. Cut-through the new noise and also have right to an educated slot web sites in britain. Regardless if you are chasing large jackpots otherwise seeking spin enjoyment, I’ve got the newest struck list. This informative guide breaks down the major Uk ports sites to the better games, bonuses, and you will a real income profits. As you’ll notice from the publication over, certain game play features is generally optional having online slots games but so it depends on the overall game you choose. Its not all position can get adjustable paylines, most feature a predetermined matter.

RTP, otherwise Return to User, is a percentage that displays simply how much a position is expected to spend back into professionals more than a long period. It’s computed centered on hundreds of thousands if you don’t billions of revolves, therefore the percent is precise finally, not in one training. You’ll find your entire favourite incentives in the casinos featuring cellular-centered spin computers. When the some thing, there’s a lot more, as numerous casinos provide cellular-personal benefits. We undertake the biggest banking answers to deposit and you will withdraw, and Bank card and Charge, spend because of the mobile (Vodafone, O2, EE, Three), Trustly, Skrill, Instant lender import and Pay Safe.

Do you know the most recent trend of online slots games?

Any kind of approach you decide on, you can do so confidently, because of the security and safety positioned at the UKGC-subscribed and you will managed web based casinos. In the OLBG, we make sure only United kingdom Gaming Fee-recognized and authorized position websites are included in all of our suggestions. It promises the protection and protection of customers’ personal and economic facts are handled correctly. Per position website must have specific information publishedpslo about precisely how buyers finance take place and you can what might happen in case away from liquidation.

Players can be do the newest cellular slots from internet casino site otherwise may want to obtain the new software. When you download the fresh slot app on the smartphone, you could potentially discover they and begin to try out the mandatory position video game instantly. You simply need to give some basic guidance before you can experiment the newest position titles. Typically, online slots British features changed out of simple four-reel, three-line setups to help you multiple creative formats and features.

Sure, Gambling establishment.British.com offers individuals betting gambling enterprise also provides, along with greeting bonuses and you will advertisements. From the Gambling establishment.United kingdom.com, you could gamble a variety of games and alive black-jack, slots, roulette, live roulette, and. Regional swimming swimming pools will often have decrease jackpot award number, whereas neighborhood diving pools yield big honours.

Deposit because of the cellular telephone casino labels give bonuses you to definitely range from acceptance offers to 100 percent free revolves and no deposit sale. Playing with pay by cell phone costs tips does not exclude professionals of any advertisements. Pay by the cellular allows you to play at the Hollywoodbets, a great and you will diverse internet casino, offering casino games and you can fun sports betting. The company also has a loyal cellular software you might download and luxuriate in an entire-services experience in your cellular phone. Long lasting you could read on the online, there is ‘not a secret slots approach you to definitely online casinos do not want your to learn about’. Ports honor gains randomly however they are geared on the online casino to retain an advantage.