Content

The term Genuine Revolves is used primarily from the NetEnt casinos, and other online casinos may use the phrase cash revolves. With one another form of spins, you’re able to remain everything you winnings without worrying on the betting standards. At the BonusTwist.com, there is certainly everything you need to initiate a safe and https://happy-gambler.com/mr-green-casino/300-free-spins/ satisfying gambling on line feel. Here are some all of our Local casino Analysis and you will Gambling establishment Bonuses for more information and get an informed web site to meet your entire gaming requires. All of us of advantages is always working to always have a knowledgeable suggestions and you may objective feedback in any review that’s considering. To make the all of these revolves, we present greatest slots in the Australian web based casinos.

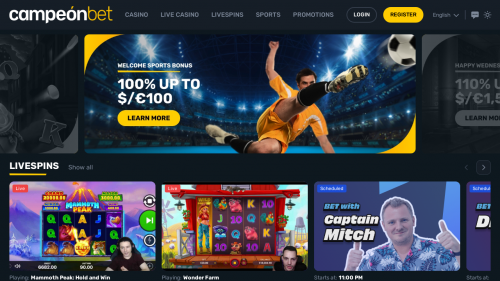

Mila has dedicated to content means carrying out, crafting outlined analytical courses and you can professional ratings. Be sure your bank account by hitting the fresh verification link otherwise entering on the password your received due to Sms. The platform computers more than 5,100 game from over 80 team, and presenting a good sportsbook and you may support one another fiat and you can cryptocurrency deals.

Tips Allege a 50 Totally free Spins No-deposit Extra

Each day totally free revolves no-deposit campaigns are lingering sales that provide special 100 percent free twist possibilities frequently. Web based casinos often give these sales throughout the events otherwise on the particular days of the new few days to save participants involved. Such advertisements try preferred among professionals as they award lingering support and you can boost betting enjoyment. All the moments it is possible to trace the brand new improvements of your wagering matter on your own membership. Take note that casinos has an optimum choice restrict if you are using a bonus. Don’t go beyond which restrict, which is £5 quite often, so you can bet their money smaller.

Enjoy Harbors and try Gambling enterprises For free

Favor a good bankroll and you will proceed with the each day or each week restrictions, and not pursue the losses. Betting criteria is the level of moments the newest winnings from the totally free revolves have to be gambled prior to they are taken since the real money. Which specifications is often indicated from the a betting multiplier, such 30x or 40x. It is crucial to know which multiplier ahead understand just how much you will want to wager. Signing up for an account in the on-line casino web site are a simple process that allows professionals to get into all of the fun game and promotions available. To get going, profiles should click on the casino hook up, which will reroute these to the fresh gambling establishment’s site.

Claim one of the best no-deposit bonuses worth 50 100 percent free spins from the finest casinos in america. Yes, most gambling enterprises require account confirmation to avoid con and procedure distributions. That it usually relates to guaranteeing the current email address, contact number, and getting proof ID. During the Joya Casino anyone can make use of fifty totally free spins to the sign up. Besides your bank account will be credited with a €10 totally free extra. As the name extremely cleverly implies, no-deposit bonuses do away with the newest economic partnership from the prevent, introducing the fresh free spins as opposed to requesting a deposit.

All of the winnings of 100 percent free spins are repaid as the cash, and no betting conditions, and also the limit cashout is actually £a hundred. By using these suggestions, participants can raise their odds of successfully withdrawing their winnings from totally free spins no-deposit incentives. Proper betting and you can money government are foundational to to help you navigating the brand new betting requirements and you can taking advantage of these types of financially rewarding also offers. Crazy Gambling enterprise offers many different betting choices, along with harbors and you can table game, and no-deposit free spins offers to attract the newest participants. These 100 percent free spins are part of the new no-deposit bonus offer, getting certain numbers in depth in the extra conditions, in addition to various local casino incentives. Just like all the Uk casinos on the internet work on an optimum cashout restrict on the fifty 100 percent free revolves no deposit bonuses.

These extra revolves paid to the membership are usually legitimate to have 7 months. Because of this you should make use of them within period, if not, they are going to expire. Don’t confuse this time on the restrict imposed by wagering criteria. If you do not roll over your own earnings inside you to definitely time frame, the fresh casino get forfeit him or her. There are web based casinos one demand players and then make in initial deposit ahead of requesting a cashout. To own 9+ many years, CasinoAlpha has expertly give-tested some no deposit also offers, installing a precise and you can comprehensive assessment methodology.

Sort of 50 Totally free Revolves No deposit Incentives

Existing people also can make the most of fifty 100 percent free revolves no-deposit bonuses as an element of commitment apps. Such apps are created to prize people for their continued patronage you need to include exclusive bonuses, totally free spins, and other benefits. The fresh players can certainly claim these deposit revolves because of the completing the new membership processes and you may verifying its email address or phone number. That is a good way to mention the fresh gambling establishment’s choices and potentially winnings a real income without any initial money. Various other key part of saying these types of bonuses ‘s the entry to discounts.

Similar 100 percent free Spins Proposes to fifty Totally free Spins

- Also, the newest rounds come with zero betting requirements and invite you to definitely withdraw all your earnings.

- There will be a small time and energy to complete the wagering to your qualified games.

- Added bonus revolves may also should be put entirely to the specific videos ports and also have its restrict choice number capped appropriately.

- Various other gambling enterprises could have various other rules and you will limit cashout limitations for winnings obtained from 100 percent free revolves.

Inside part we reveal more info on 1st added bonus words you have got to take a look at before you allege a great fifty 100 percent free revolves extra. Checking incentive conditions helps you stop unpleasant shocks. I don’t want you so you can allege a bonus and also have stuck up inside the doggy added bonus words.

Simple tips to Withdraw Your own 100 Free Revolves Winnings

Before we obtain to your simple tips to claim their 888casino 100 percent free spins, let’s rapidly discuss exactly what a no deposit extra actually is, and exactly why that one’s value a peek. But once a casino such 888casino leaves up an alternative fifty 100 percent free spins render no deposit necessary, it’s anything i look closer during the. At all, this can be a long-dependent brand name that have a great track record regarding free spins, and I am happy to declaration the fresh give sticks compared to that algorithm. BonusFinder.com is a person-determined and you may independent gambling establishment comment site. Delight look at the local laws and regulations just before to experience online in order to make sure you try legally permitted to engage by your many years and on your jurisdiction. The new users away from gambling enterprise webpages can simply rating local casino promos, which will are free revolves no deposit incentive.