Think about, the new charm away from progressive jackpots lies not only in the new honor but also regarding the excitement of your own pursue. NetEnt stands out featuring its official fair video game and you will a catalog from moves in addition to Gonzo’s Journey and you can Stardust. Because the the leading designer recognized for pushing the brand new borders away from on the web position gaming, NetEnt’s designs is actually a great testament for the team’s commitment to perfection. Remember that the fresh court playing years to own online slots games is 21 for the majority All of us states, very ensure you’re also old before dive to the arena of online gambling.

The fresh Amazingly Sunlight Position RTP try 96% that have a max victory of £4,100000 across 10 paylines. Almost every other slots having a comparable come back to pro rate is Royal Nuts, Emperor’s Champ and you can Aztec Cost Look. Effective a modern jackpot will be arbitrary, thanks to unique incentive video game, or by hitting specific symbol combinations. No matter what strategy, the fresh excitement away from going after such jackpots provides participants coming back for much more. The online game provides growing wilds and you can re-spins, significantly increasing your winning opportunities with each spin.

Gnome slot machine – Relevant online game

To try out in the signed up web based casinos will provide you with one to additional defense and you will comfort. Simply visit a genuine currency on-line casino including Very Harbors, World 7 Gambling enterprise, or Crazy Gambling enterprise. Check out the better menu website links you to definitely say “Slots”, “Latest”, “Jackpots”, otherwise “Top”.

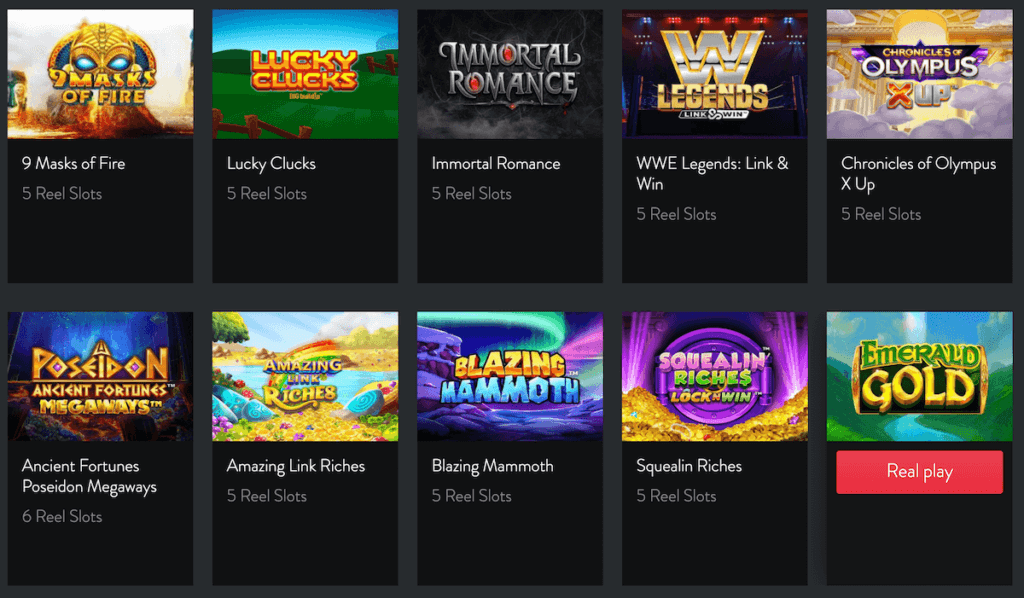

Las vegas Gambling establishment Online flash games and you can Application Organization

Temple From Success DemoAnother one to believe ‘s the Temple Of Success demonstration . The motif are old forehead guaranteeing success having a release time in the 2023. The game have Higher volatility, a keen RTP of around 96.2%, and a max earn away from Gnome slot machine 10000x. Amazingly Sunshine, the online position was designed by the a family to the label Play’letter Wade. For individuals who’re looking studying titles much like Crystal Sunshine a powerful first step is through reviewing Enjoy’letter GO’s partner-favourite titles.

Generate a display – Get a win

- As soon as your money are deposited, you’re also ready to start to try out your favorite position game.

- While they improvements, people will relish pros and you can rewards such monthly bonuses, seasonal incentives, cashback bonuses, increased distributions, and also birthday and you will anniversary bonuses.

- What’s never to including in the an on-line casino that may render its players as much as $a thousand for only deposit money on their profile?

- The newest brilliant crystal sun apply a celebrity-molded base is the wild icon.

Crystal Sunrays includes an enthusiastic autoplay feature enabling you to definitely lay a fixed number of revolves to experience instantly. This can be helpful if you need a more give-out of strategy or need to look after a regular playing development. Insane suns can be 1x, 2x otherwise 3x multipliers and will mount up to proliferate an excellent prize from the around 9x their new value. This means your’ll have a chance to earn around cuatro,000x their bet otherwise eight hundred,100000 coins. Amazingly Sunlight provides a wager away from $0.step 1 (, in order to £0.08) and you can enables wagers to $one hundred (, around £80).

The place to start Playing Slots On the internet

- For each class also offers book provides one appeal to other choices.

- The brand new local casino aids several payment steps, in addition to handmade cards, e-wallets, and you can cryptocurrencies for example Bitcoin and you will Litecoin, guaranteeing prompt and you may easier purchases.

- This type of game are fun, have effortless-to-know laws and provide grand earnings.

- Big time Playing will be your wade-to to own ports for the threat of substantial earnings.

Wagers in the Light Bunny Megaways vary from $0.ten to $14, with regards to the online casino. Starburst wilds appear on reels dos, step three, and cuatro and you will option to the signs. You’ll result in an excellent lso are-twist for approximately three full 100 percent free revolves when the Starbust wilds develop over the reels. The newest RTP and gambling restrictions in the Doors from Olympia one thousand eventually trust for which you play the game at the sweepstakes casinos. Even when Michigan people wear’t access sweeps internet sites, it’s nonetheless you are able to to sign up and you can play for 100 percent free.

Popular Organization

Play’letter Wade, the brand new merchant accountable for away from Amazingly Sunshine, have adjustable RTP options for the many their online game. You might consider RTP range as part of slot game play while the just like blackjack who has some other laws. During the specific gambling enterprises, the new bet are refunded to your pro whenever 18 is actually removed from the both the user and you may specialist because’s sensed a click.

The way we price & opinion online slots games gambling enterprises

Eventually, every time an untamed symbol appears, they increases to pay for reel totally, improving likelihood of scoring prizes. After the extension, the newest insane symbol lives in reputation while you are a re also-spin happens. In the event the a lot more crazy icons home, much more lso are-spins try offered as much as all in all, three per bullet. The fresh icon in charge of all games’s provides is the wild icon.

End chasing loss and always remember that gaming is going to be a great form of amusement, no way to generate income. By following this type of in charge playing practices, you may enjoy to try out slots while keeping it fun and secure. Listed below are some of the finest online casinos to own slots and you may exactly why are him or her be noticeable. At the rear of all of the higher position online game try an application supplier whom crafts it with precision and you may welfare.