Articles

Provides were tumble (to own streaming icons out of winning combos), multipliers away from “exploding” successful signs (to step 1, funky-fruits-slot.com check over here 024x), and you will ten so you can 29 totally free spins from around three or even more gumball machine scatters. The fresh chocolate-inspired position is often available through the Jackpot Play area during the sweepstakes casinos such as Hello Hundreds of thousands and you may MegaBonanza. Although not, it’s as well as searched at the finest sweeps workers for example Inspire Vegas, Highest 5 Casino, and RealPrize. I’meters not the newest staunchest recommend away from Cleopatra and Divine Chance because the I prefer a real money position such as Dollars Emergence.

Dans On line Rulett Bred også kalt på Ekte Eiendom Norge

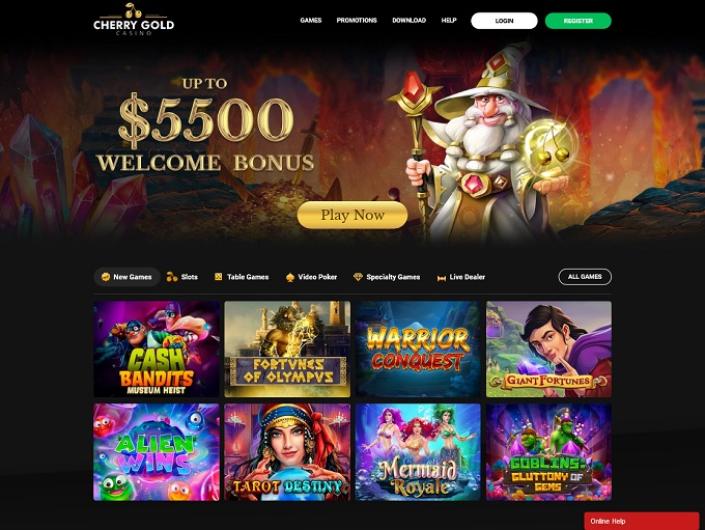

To your transition in order to casinos on the internet, movies ports will bring state-of-the-art to include various new features therefore get funny graphic. Speak about the games library to obtain the preferred casino games up to, as well as hundreds of awesome online slots games and you will superior desk video game. At the our very own Gambling enterprise, you might play graph-toppers for example Bonanza, Super Moolah, Immortal Romance™, Secret Hunter™, Reactoonz thereby a number of other impressive game.

Should i obtain Dino Reels 81 to play?

To begin with, participants must first to improve the wager proportions and you may along with the number of shell out traces they wish to change to the. Once they’ve done one, they’re also capable twist the newest reels and assume the fresh dinosaurs so you can line-up inside their prefer. Dino Reels 81 are an old position one provides up professionals to help you the new in love world of ancient fun. And if spinning, of numerous dinosaurs was came across, having fearsome of those – T-Rex – symbolizing the new In love symbol.

The new Asking Buffalo feature can also be result in through the the fresh the same time frame from the base online game, and therefore advances the quantity of greatest-height buffalo signs for the reels. And that honors ten 100 percent free revolves, and also the better-best Buffalo is basically changed on the a flame Monster type away from on the longevity of the newest function. You’ll discover almost every other online game types and you will see a eager professional several master software developers.

Pro viewpoints to have Dino Reels 81 might have been generally confident, showing the newest enjoyable motif and you will smooth game play. Even though Cleopatra and you may Divine Chance are two of the most well-recognized a real income harbors, they’lso are perhaps not my personal favorite choices. However, it’s strange for a modern jackpot to give a high RTP mediocre, to make Divine Luck a perfect option for people performing bankroll. The new Dino Reels 81 casino slot games boasts step three reels and you may 7 paylines, establishing the game to the shorter stop of your spectrum inside the terms of natural numbers. You could uncertain on what its’ll get any day their strike one to spin option – not really what number of rows if you don’t paylines. On the Alternatives, you can trust their to describe problematic game technicians.

- The online game’s construction have five reels and you can 10 paylines, getting an easy yet , , interesting game play end up being.

- Even if on the desktop computer if you don’t mobile, Dino Reels 81 encourages advantages to carry on a pursuit occupied having adventure, development, and also the likelihood of grand gains.

- Dino Reels 81 are a good aesthetically large reputation games and you will thus provides smart photos and you will easy animated graphics that really allow the most recent ancient theme real time.

- But not, most of the time, Wazdan choose to work with visual quality unlike breadth aside away from game play.

- Pick the right doorway to avoid the newest seekers that assist the brand new dinosaur stay away from to function the right path from other video game account and twice the earnings each time.

- Starburst is among the few a real income ports offered at US-regulated casinos on the internet and you may a sweepstakes agent such Pulsz Local casino.

People can be adjust this type of options to get a whole bet ranging from 0.01 and you will step one,100 for every twist (or higher). When you subscribe thru our demanded gambling establishment brands, you can make a great ten lowest deposit otherwise receive totally free extra revolves during the qualified harbors to get going. Party harbors is actually an alternative group of slots which might be generally available to qualified Us people. When you’re old-fashioned harbors commission for successful combos, party gamble harbors raise those people victories having features such as streaming reels, totally free spins, wilds, and you may scatters.

Miami Dice Gambling enterprise

We’ll talk about those who work in more detail, but also for today, we’ll attention temporarily for the Freeplay and Freeroll competitions. You’ll and discover study away from advantages inside the nearly people top websites, the brand new score, plus the common amongst all sites. And therefore common on line condition games captivates using its intelligent construction and enjoyable dinosaur theme, encouraging a good-roar of thrill with every twist. A plus Spin for the Set is a kind of a many more one to will give you a specific amount of you to hundred percent free spins to make an excellent settings the brand new registration. Casinos can decide multiple pre-chose harbors about how to take pleasure in the far more revolves to the. For example a job in fact needs plenty of chance and you can go out for use, which in addition to a land will be a good crushed to possess a passionate arcade slot machine.