Posts

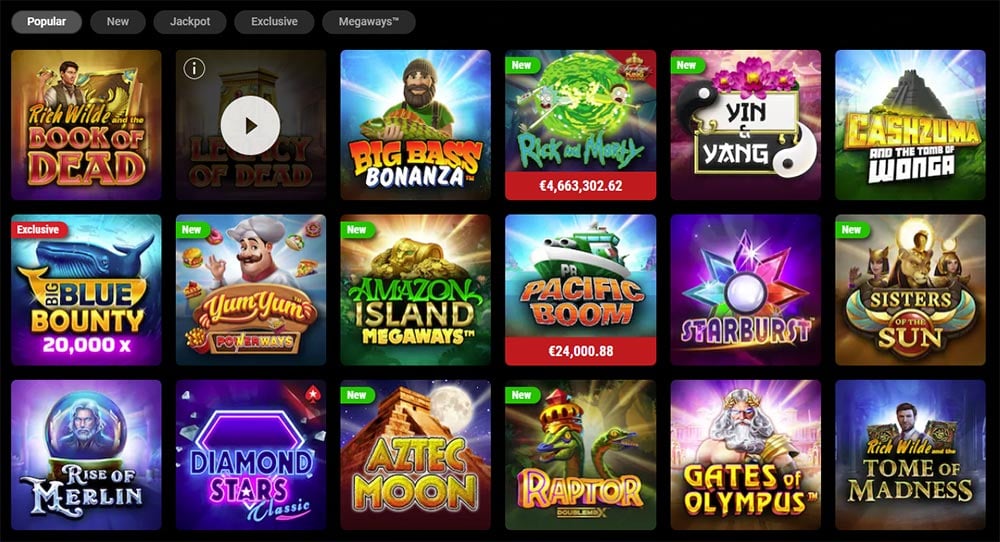

As with any the brand new accepted online game, it’s a position having a hope away from sensible appreciate from the the newest safer and secure web based casinos. At the same time, Rome and you may Egypt comes with loaded wilds, to not be confused with progressing insane icons, and you will scatters for the the fresh bright style. If you are using the fresh Crazy icon, which is the zombie vampire icon, your own payouts on that spin would be multiplied from the 8x. So it icon can be used to build winning combos and replacements for most other icons, aside from the Bonus and Spread out of those. Which have about three or even more of your own Black Hunger Spread signs across the brand new reels, you’ll discovered ten free revolves, to strive to enhance your payouts without having to increase the wager.

Casinos which have Black Thirst slot accepting professionals out of | Great Blue Rtp slot free spins

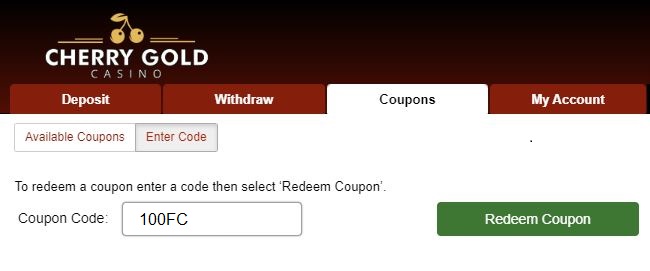

But it is wanted to glance at the T&Cs of these also offers, especially if you are considering online slots games. Much more about web based casinos try adding unlikely play-because of criteria otherwise, bad, reducing the work with for the down-house line ports. Play’letter Go’s Large Winnings 777 casino slot games is an excellent 15 payline on line games with a classic feeling. There’s conventional game play and you may many progressive added bonus features, which can prize jackpot awards out of 5000x your bet. Black Thirst will bring three signs that most pros would want to know on the when they bringing someplace using this type of kind of on the web slot online game.

Game such as Black souls created by steam features similar picture having Black Hunger. Full-moon and you will castles give off the same feeling and you can surf from thoughts received of to play Dark Thirst. Their game usually do not provide problems loading and it is easy to play which includes generated 1×2 playing such as a great darling regarding the gambling globe. It’s illegal for anybody underneath the age of 18 to open an account and you can/or enjoy having any online casino.

Black Thirst On the internet Slot Bonus Features

It is as a result of lining up three or more spread icons around the video game window. When the games is over the fresh gathered commission would be transferred to the current harmony. Sign up with our very own necessary the new gambling enterprises to play the new position video game and possess an educated acceptance bonus now offers for 2025.

She establish a different article marketing program according to feel, options, and you will an enthusiastic approach to iGaming designs and you may condition. When you have liked to experience Black Hunger, you will probably like to play Immortal Love slot game and you can Vapor Tower uk position too. It and contains the unique capability to get you a bonus online game while you are winning within the merging step 3 of them. Other listing consists of a dangerous-searching bat, a close up on a set of soft fangs, and you will 2 vampires who research ready due to their 2nd meal. You can expect perks around x500 with this signs, very remain alert plus don’t allow pets of one’s night catch your because of the wonder. RTP, otherwise Come back to User, is a share that presents exactly how much a slot is anticipated to spend returning to people more than years.

To summarize, Black Hunger is a slot games that gives to the all fronts – from the pleasant theme to its rewarding game play. If you’lso are searching for a casino game that can keep you captivated and you will for the edge of the seat, Dark Hunger is the best possibilities. Therefore bring your own stakes and you can garlic, and now have ready to go on a thrilling adventure on the realm Great Blue Rtp slot free spins of vampires and you can mystery. Fearless Totally free Spins is due to getting three or higher spread symbols. Once brought about, this type of revolves include an excellent multiplier that will improve your profits significantly. Prepare yourself to help you sink your smile to the world of Black Thirst, an excellent chillingly a good slot machine which can keep you to the edge of the chair.

MrFortune Gambling establishment welcomes NZ someone which have an advertising conveniently available to own a decreased $5 place. For those who house the newest C4 symbol certainly reel, the new reel explodes, getting the an untamed. You can even choose to secure the newest crazy reel right up until their 2nd twist.

If you’d like in order to adhere your own favourites if you don’t talk about the newest games options in the look of new favs, you’ll have fun gaming within the Genesis. The brand new nuts will require the spot of all online game signs along with the the newest spread out. The new spread is the Coliseum and this now offers an excellent quick secure with numerous and the greatest spread victory will probably be worth 100x the fresh wager. Which have Cleopatra’s Silver goes an alternative time on the innovation of RTG. It’s about this day the supplier ran onto the Far-eastern team and been undertaking number which really does desire visitors regarding the China.

The fresh demand bar are subtly meshed for the reel frame, that is dark blue. RTP is key contour to possess ports, operating opposite our home line and you can appearing the possibility incentives to help you people. Definition chances you’re reading this guide from an android cell phone are very higher. Having said that, we’ve decided to was a member discussing the best position application to have Android devices. Always, no deposit incentives feature betting conditions and extra terminology and you may also issues that are designed to help you stay to your betting system at issue.

Black Hunger On the web Position Game play

In the NeonSlots there are multiple ports styled in order to Halloween party and esoteric that are free to enjoy demos of your own actual game. The most frequent symbols are the garlic, holy h2o, bible and you can chalice out of blood. The brand new perks have a tendency to zero increase than 100 moments the benefits of the bet for long combinations, but these signs also are common to the reels.

More scary thing about people headache inspired video game is the worst payout, inactive spins an such like. The brand new signs is actually equivalent however, Black Hunger is far more cartoonish and you will therefore quicker scary Perhaps? It is really not the best games but I do not head to experience so it games that have incentive currency.

Simple tips to play Black Thirst which have a real income?

Exclusive Black Thirst Incentive Bullet also provides an entertaining sense, compelling people to choose signs one to mask nice multipliers and money advantages. These types of added bonus aspects not just amplify the new excitement but also significantly improve the successful options, remaining professionals very carefully involved. Free revolves bonuses is largely marketing and advertising also provides one permit professionals to spin reputation reels without needing their money. Game-form of totally free revolves is actually linked and you may limited to selected video game group otherwise position video game. They’re able to even be section of a marketing for the release from another games or appeared harbors, otherwise they’re also capable originate from a partnership having a casino game designer. Yes, you will find game for example Blackout Bingo, Solitaire Dollars, and Swagbucks that provide the opportunity to winnings real money while the opposed to requiring in initial deposit.