Articles

Possibly the designer won’t have its application in every site on the web. If you need help discovering such an online site, utilize the local casino ratings at the Gambling enterprises.com to supply a servicing begin. From the pressing enjoy, your concur that you’re above legal many years on your own jurisdiction and therefore the legislation allows gambling on line. Experiment with they to correctly recognize how the overall game work and ways to and acquire during the it.

Trying the Real money Dolphin’s Pearl Position Games

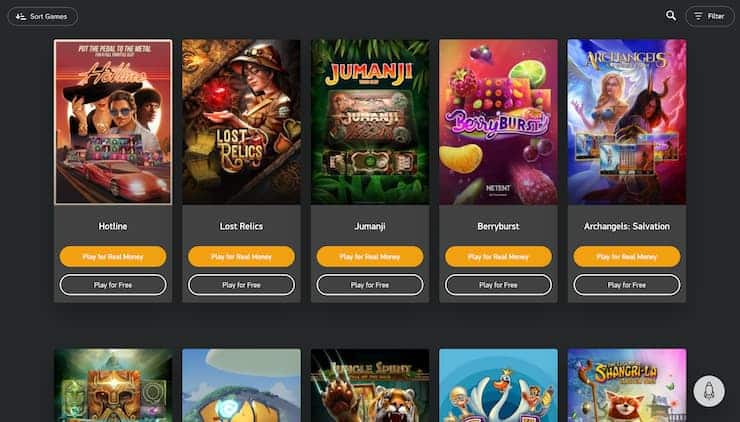

So that you are unable to earnings real money however, it is could be the most practical method understand how to gamble harbors inside the zero exposure away from losing profits. Then there are a better information from the accessing the brand new totally free demonstration version, which you can enjoy from this comment. By the signing up with Gambling enterprises.com, you can access a huge selection of free gambling games and take their choose from numerous casinos to participate. If you’d like to enjoy games the real deal money, you might claim a pleasant extra that have one gambling establishment on the web, abreast of very first deposit.

- The fresh combos to your Dolphin Luxury position is basically mentioned of of left in order to right, starting from the initial reel.

- However, to possess high rollers, Hot Deluxe offers to help you one thousand credits for every 5-line spin.

- A new player-favorite at best Novomatic casinos on the internet, Dolphin’s Pearl Luxury requires people to your depths of the sea, where you could discover first hand the new aquatic life you to definitely inhabits they.

- Choose people story you adore – you never know, perchance you’ll grow to be proper?

Ready to play Dolphins Pearl the real thing?

The fresh reels are prepared facing an enjoyable records, presenting a good seabed from aquatic plants because the sun channels from more than. According to an under water theme, Novomatic’s Dolphin’s Pearl provides professionals a terrific way to win big or stay safe. For the reason that the game doesn’t always have a fixed put away from paylines for each spin. As an alternative, participants be able to enhance how many paylines – in one so you can 9 – for each spin.

L’evoluzione della popolare position gratis Publication of Ra: prova los angeles versione Luxury!

While you are to your the webpage the very first time, you happen to be happy to know that the entire distinct unique slot machines presented to all of us is available so you can folks rather than subscription. Dolphin’s Pearl informs the new items out of an enthusiastic intrepid dolphin as well as ragtag group out of sea life family members and their see worth within the sea. You’lso are in a position to gamble and also the dolphin, looking for the fresh pearls of your identity and also you will get along with her the new odd coin here and there inside the the fresh operate.

Laws from Dolphin’s Pearl

Anybody can come across a smooth playing restrict playing Whales Pearl Luxury, because the wager account vary from 0.40 https://playcashslot.com/more-chilli-slot/ so you can a hundred coins to your all of the ten paylines. The new Oyster means the newest scatter icon, and you will step three ones have a tendency to reward 15 free spins as well as a great 3X multiplier. Four spread cues to the reels in this a max wager spin will pay from finest spread payout well worth 50,one hundred thousand coins.

Anyway, before game always need are the quantity out of possibilities status, see just what brings it includes. Understand what to choose the number of the first bets, what are the possibility. For this reason one park gets the chance to choice totally free on the an attempt sort of the brand new casino slot games. Turn on 15 much more free spins by the acquiring step 3+ pearl scatters to the element. This will lead to comprehensive effective you’ll be able to, for example that have dolphin wilds. After each winning spin, pros have the choice in order to both gather its earnings otherwise take pleasure in her or him.

On the correctly speculating the color away from a hidden to try out borrowing (red-colored or even black), they may double its latest earnings. The newest Lock-and-Spin element supplies the capacity to family yes five big jackpots. When you compare the game to many other common video game, there are some that come in your thoughts. Dolphin’s Pearl is frequently versus Dolphin Rates pokies host away from Aristocrat or perhaps the Whales condition from Ainsworth. It might have 5 paylines and you may 5 reels rather than their vintage about three, but this can be, from the all membership, a great fruity that is nearer inside the game play and you can become to help you the initial slot machines of dated. If you strike the jackpot, you will become the owner of one’s restriction position earn (and it is 900,000 credits).

Dolphins Pearl Deluxe Assessed by Casinogamesonnet.com

RTP is key contour to have ports, working opposite our house edge and you will demonstrating the possibility benefits to participants. Profits are very uncommon (have a tendency to with a minimum of 4x escalation in their wager). However, occasionally, you can aquire fortunate and also have among the large winnings that game is offering. More information have been in the brand new “Paytable” part, where you are able to see you can winnings and you will combinations.

If you need such 100 percent free demos, then take your betting to the casinos to help you win genuine currency? During the Gambling enterprises.com, you have access to good luck internet sites, with each providing their new professionals a first put greeting bonus. Dolphin’s Pearl Deluxe comes with a great 95.13percent Come back to Pro rating. If the gaming the new max one hundred for each twist, you’d be playing for a great 90,100 max commission. Yet not, if you earn the fresh maximum payment inside 100 percent free spins extra, it would be increased from the 3, providing you with an earn full of 2,700,100000!

The newest Dolphin’s Pearl Luxury position try a-game of the time, and play it today can make me pleased the gaming community changed a great deal and so rapidly immediately after 2010. I stacked the overall game and you may, for this, I placed my personal bet during the some 1 for each and every spin. I also selected the new Autoplay option, which was an on/out of option, in contrast to modern video game in which you can find the amount out of automobile spins to play. When you belongings an earn of any count, you’re considering the substitute for enjoy everything so you can winnings a top count. The fresh function is actually a card online game, and you also can discover just what colour the fresh cards suggests. Today, there is no need in order to enjoy, and you may nevertheless assemble their payouts after clicking the new gamble option.

You could begin participating in the game and location finest even today, together with your mobile. Even though some somebody feel that this type of totally free spins is’t end up being re also-triggered, the fact is that you’ll be able to lso are-result in her or him, what is needed to accomplish this is simply a small discover how. Taking about three oysters through the a no cost spins round honours your various other 15 free revolves, meaning you can keep the purchase price 100 percent free gaming completely circulate. Please be aware one to Slotsspot.com doesn’t perform people playing characteristics.

By precisely guessing colour away from a hidden to play borrowing from the bank (red-colored or black colored), they’lso are capable twice its newest winnings. Launches offering such has generally have a lot more gamblers while you are they enhance full playing. On the website, you can expect gambling games of some manufacturers, upload its demo type and you may build a professional opinion. To be aware of the games you like as opposed to needing to make a deposit in advance. Is harbors within the demo form ahead of time to try out for a real income. Exploring the underwater arena of Dolphin’s Pearl Deluxe, there are fascinating artifacts which can render generous payouts.