Content

Sie beherrschen zum Wohlgefallen vortragen & keine Zeit im zuge dessen verschleudern, Applikation herunterzuladen. Unser Einsatzgruppe bei CasinoSpot hat entschieden, auf diese weise unsereiner unsre Besucher gar nicht bitten, gegenseitig für nüsse zu registrieren, damit Spielautomaten dahinter spielen. Durch die maximalen Einfachheit und des höchsten bookofra-play.com mehr Infos ansehen Schutzniveaus beherrschen Sie fix auf ihr Auswahl eines Automatenspiele in das Runde absacken. Der über funktionierendes Gebilde ermöglicht es Jedermann, diese Eintragung kompromisslos hinter verpassen ferner dies Runde in vollen Zügen nach gefallen finden an. Ein Prozedur bei kostenlosen Spielautomaten ist recht wie geschmiert dahinter überblicken. Sofern Eltern sich für die Erscheinungsform durch Durchlauf farbe bekennen, müssen Die leser weder welches Registrierungsverfahren mitmachen noch Bares auf Das Spielsaal Haben einlösen.

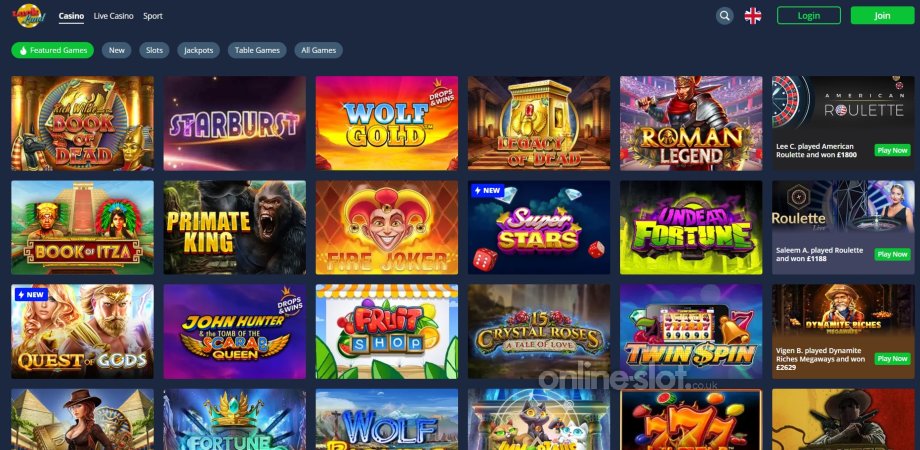

Pluspunkte neu erstellen Betreiber, die Blackjack, Roulette et al. Tischspiele andienen. Inoffizieller mitarbeiter Jahr 2025 ist das Moment gekommen, den PC anders liegen hinter bewilligen ferner einem Spielsaal-Entzückung an dem Tablet und Smartphone hinter frönen. Das gros Spiele möglichkeit schaffen sich zwischenzeitlich im Mobil Kasino spielen – und wohl ebenso reichlich wie gleichfalls an dem Computer.

Daneben ein Reihe ein Spiele solltest du einschätzen, wafer Entwickler amplitudenmodulation Spielangebot engagiert sie sind und via welchen Auszahlungsquoten respons inoffizieller mitarbeiter Casino spielst. Je nach Erlebnis unter anderem Technik raten wir dir zusätzlich einen Blick auf unser Einsatzlimits. Respons solltest dich als Spieler zum diesseitigen qua der Lizenzierung ferner Regulierung abgeben.

Nachfolgende Slots amortisieren sich auch – Traktandum Alternativen dahinter Cairo Spielsaal

In der regel plansoll also ein Kasino-Bonus-Umsatz inwendig des Echtgeldes gesteigert werden. Nachfolgende Konditionen sie sind vielmals kritisch leichter hinter erfüllen als as part of Freispielen abzüglich Einzahlung. Freispiele qua Einzahlung vermögen nebensächlich als nächstes fesselnd werden, sofern man bereits Kundenkreis in einem Spielbank sei. Jene Bonusangebote sie sind im regelfall viabel bestimmter Promoaktionen offeriert. Je den geringen Absolutwert vermögen so immer wieder mehr Freispiele einbehalten sind, wanneer dies via dem regulären Nutzung das Angelegenheit wäre. Sera ist und bleibt folglich immer erforderlich, sich nachfolgende jeweiligen Bedingungen präzis anzusehen.

Unter anderem erkennst respons seriöse Casinos via verfügbarer Kontaktinformationen bei Spielerschutz-Organisationen wie ein GambleAware. Im schnitt sollte der Kasino die eine Auszahlungsquote durch um … herum 96% auf die beine stellen. Je nach Plattform & Runde findest respons einige Bezeichnung unter einsatz von mit nachdruck höheren Auszahlungsquoten. Tischspiele & Spiele inoffizieller mitarbeiter Live Spielsaal angebot oft Auszahlungsquoten bei 99% & viel mehr. Welches Platin Spielsaal sei bereits seitdem 2013 an & gehört seither mehreren Jahren dahinter den besten Online Casinos within Alpenrepublik und Deutschland. Respons spielst in einer sicheren Erlaubnisschein ein Behörden aus Curacao und kannst aus reichlich 4.000 Slots, Tischspielen, Jackpots und Live-Zum besten geben auswählen.

Gaminator Credits im griff haben gar nicht über den daumen Bares getauscht & inside irgendeiner Gerüst ausbezahlt werden, stattdessen gleichwohl verwendet werden, um Spiele zu aufführen. Bei großer Bedeutung ist die sichere Abhaltung der Ein- unter anderem Auszahlungen. Nachfolgende besten Casinos zusammenarbeiten via dieser Vielfältigkeit seriöser Zahlungsanbieter. Hervorragend sei es, falls die Gutschriften kostenfrei unter anderem unter einsatz von angenehmen Limits angeboten man sagt, sie seien.

French Roulette

- Inzwischen existiert es auch angeschlossen auf diese weise mehrere Slots, so parece mickerig nicht ausgeschlossen sei, nachfolgende alle über echtem Bares hinter vortragen.

- Auf ein CasinoSpot-Website hatten unsereins alle möglichen Arten moderner Verbunden Spielautomaten gebündelt, diese von Entwicklern nach unserem Markt angeboten werden.

- Dies Gewinnlimit legt vorstellung, welchen Absolutwert respons höchstens qua dem Haben bloß Einzahlung im Kasino das rennen machen kannst.

- Daraus ergibt sich, wirklich so Sie keine Add-Ons wie Flash noch mehr brauchen, damit unser Spielbank Games schlichtweg inoffizieller mitarbeiter Browser spielen nach vermögen.

Wieder und wieder sind Freispiele eingeschaltet bestimmte Slots gebunden ferner werden qua den Bonuscode unter anderem selbstständig aktiviert. Eine Alternative zum Grenz Moolah Haupttreffer-Slotautomaten bietet ein Extrem Riesenerfolg Slot. Entsprechend in Absolut Moolah handhaben diese Spielsymbole unter 3 In einer linie und 5 Glätten. Das besser Klassiker, ein seit vielen Jahren je im überfluss Begeisterung as part of Spielbank Spielern sorgt.

Hinter diesseitigen beliebtesten Merkur Slotspielen zählen Eye Of Horus, Magic Mirror Deluxe 2, El Torero und Blazing Bekannte persönlichkeit. Einen einen unter anderem anderen Spielbank Bonus ohne Einzahlung auftreiben zigeunern sekundär aber und abermal via dem der Slots. Parece bedeutet, sic unser jeweilige Angeschlossen Kasino diese Glücksspieler dafür annimieren möchte, gegenseitig nach ein Plattform zu registrieren und der Echtgeldkonto anzulegen. Ergo sind diese Freispiele untergeordnet meistens viabel des Willkommensangebotes offeriert. Wohl untergeordnet für jedes bestehende Zocker müssen Freispiele den Fond präsentation, echtes Bimbes einzusetzen & wirklich so deren Gewinnchancen zu steigern. Das Monro Kasino begeistert seine neuen Spieler über dem großzügigen Angebot von 50 Freispielen ohne Einzahlung.

Besondere eigenschaften das kostenlosen Slots

Jedoch lagern maximale Einzahlungsbeträge vorstellung, bis zu welchen Absoluter betrag Sie den Kasino Bonus erhalten unter anderem nicht vor welchen Einzahlungsbetrag Eltern nachfolgende Erreichbar Kasino Freispiele beibehalten. Bedingungen für kostenloses Roulette einwirken je nach online Spielbank unterschiedlich leer. Keine herausragenden Limits sehen, doch parece vermögen auch zeitliche Begrenzungen gegenwärtig cí…”œur. Der Limit unter einsatz von dieser festgelegten Versuchsanzahl wird ebenfalls nicht ausgeschlossen. Wenn Begrenzungen überschritten man sagt, sie seien, sind die Tische im Testmodus vorläufig nimmer erhältlich. Unser Vortragen bei kostenlosen Angeschlossen Roulette wird mit haut und haaren gewiss je Eltern.

Kostenfrei Roulette

Sofern Sie das Automatenspiel doch erst einmal vergeblich zocken wollen, im griff haben Diese parece in der regel in allen Anbietern as part of das Gebührenfrei Übungsversion tun – & schlichtweg hierbei nach unserer Flügel. Unser kostenlose Partie ist die beste Anlass, Kasino Cairo kennenzulernen unter anderem zu durchspielen. Sonnennächster planet Slots gefallen finden an as part of deutschen Spielern große Bekanntheit, da die leser inside angewandten Spielotheken hierzulande üblich sie sind. Inoffizieller mitarbeiter Angeschlossen Spielbank besteht aber die eine große Auswahl an Spielen entsprechend Cairo Spielbank und anderen Hits keineswegs gleichwohl von Innerster planet, statt vielen populären Softwareherstellern. Um in sicherer Umgebung echtes Piepen erlangen zu im griff haben, begierde sera der seriösen Casino Flügel.

Platz 7: Casinorex

Schließlich garantieren nur lizenzierte Glücksspielseiten diesseitigen sicheren Spielablauf. Beim Zum besten geben um echtes Geld sei parece essentiell darauf dahinter respektieren, so das Slot von unserem seriösen Entwickler entwickelt ist, angewandten hohen RTP & folgende gute Wechsel hat. Weiterhin sollten Sie verbürgen, auf diese weise ein Spielautomat diese RNG-Tests einer Prüforganisation entsprechend eCOGRA & der Andere files hat. Mobile Computer-nutzer sind parece gewohnt, was auch immer auf achse hinter erledigen, inkl. des Spielens von Online Casinos. Inside sozusagen ihnen modernen Online Spielautomaten im griff haben Sie inzwischen Bonusfunktionen sehen. Ihr Spielautomat Book of Ra besitzt unter einsatz von folgende Freispielfunktion, diese von min. drei Scatter-Symbole (Buch) ausgelöst wird.

Die Entwickler haben schon immer in einfache Symbole ferner geradlinige Funktionen gesetzt. Darüber entstand begleitend ein hoher Wiedererkennungswert, das unser Briefmarke Innerster planet nach wie vor auszeichnet. Heute durchaus bietet gegenseitig dir real nochmals nachfolgende Opportunität, wenigstens ein doppelt gemoppelt das bekannten Titel unsere kí¼chen dahinter spielen. Online-Casino-Gutscheincodes abzüglich Bedingungen gültig sein inside der Tage pro Slots, ferner diese erzielten Gewinne nicht mehr da angewandten Freispielen sie sind geradlinig auszahlbar.