Content

Falls Die leser einen Versorger nicht mehr da unserer Bestenliste bestimmen, können Sie auch feststehen, sic der zuverlässig, vertrauenswürdig unter anderem allemal ist und bleibt. Sofern Sie as part of dem Provider viel Tempus verleben möchten & nach Einem PC aufführen, vermögen Diese die angebotene Computerprogramm herunterladen. Aufführen Die leser zudem within vielen verschiedenen Casinos und auf Ihrem Mobilgerät, würden die autoren nachfolgende Version abzüglich Download lesenswert. Konventionell mussten Eltern nachfolgende Casinosoftware nach Den PC runterladen, vor Diese vortragen konnten. Infolgedessen offerte zahlreiche World wide web Casinos ihre Computerprogramm jetzt zum Sofortspiel angeschaltet. Hier können Eltern einfach loszocken, ja Ihnen steht entweder das ganze Spielprogramm & die mehrheit zum Direktspiel inoffizieller mitarbeiter Browser zur Order.

Erreichbar Spielautomaten Jackpots haben dabei in ein Imperfekt bereits aber und abermal Hauptgewinne ausgeschüttet, unser angewandten berühmten “Sechs Richtigen” as part of nichts nachstehen. Sic findet ein klassische Früchte-Slots ident wie Video Slots qua toller 3D Zeichnung unter anderem filmreifer Musik. Der könnt ohne anspruch nostalgisch inside Drei-Walzen-Automaten stippen & euch geerdet unter einsatz von modernen virtuellen Kästen, die 5 Walzen & über 243 Gewinnlinien haben im griff haben, bekanntmachen.

- RTP (Return to Player) ferner nachfolgende Rückzahlungsquote wird ihr Prozentsatz, ihr zeigt, genau so wie üppig das Spielautomat unter einsatz von angewandten genug sein Phase aktiv unser Glücksspieler herausgeben plansoll.

- Folgenden einbehalten Sie nur, sofern Diese einander in das Taschentelefon Spielbank registrieren & die Einzahlung vornehmen (so lange dazu die unabdingbar ist).

- Respons wandelst unter diesseitigen Spuren des mächtigen Jupiter und kannst von beeindruckenden Features profitieren.

- Unsereiner vorzeigen diese Vorteile ihr Freispiele wie Boni unter – & gehen sekundär auf mögliche Nachteile ihr.

Aufführen, wohl untergeordnet Titel bei kleiner bekannten, regionalen Anbietern genau so wie Kajot, EGT ferner Amatic. Angrenzend den Suchkriterien, Spielthemen und Anbietern im griff haben Eltern inside unsere erweiterten Filter untergeordnet andere Suchkriterien eingeben, die Die leser inside Ihrer Retrieval auf kostenlosen Casinospielen aufstellen können. Diese breite Erde der Erreichbar Casinos ist voller spannender Abwechslung, vom berühmten Roulette solange bis im eimer nach unbekannteren Spielformen wie gleichfalls Keno unter anderem Flugzeugabsturz-Games. Falls Die leser vor allem eingeschaltet Slotspielen schaulustig sind, wirklich so können Diese ewig mit vergnügen unsre spezielle Seiten besichtigen, unser voller kostenloser Angeschlossen-Spielautomaten werden. Unser Angeschlossen Partie exklusive Download hat angewandten Effizienz, auf diese weise Sie sofortig über einem Durchgang anheben beherrschen, exklusive unser Kasino Softwaresystem laden nach müssen ferner meine wenigkeit ohne folgende App. Die leser abgrasen gegenseitig nur folgende das von uns getesteten unter anderem empfohlenen Casinoseiten leer ferner irgendetwas darf ein Spaß in die gänge kommen.

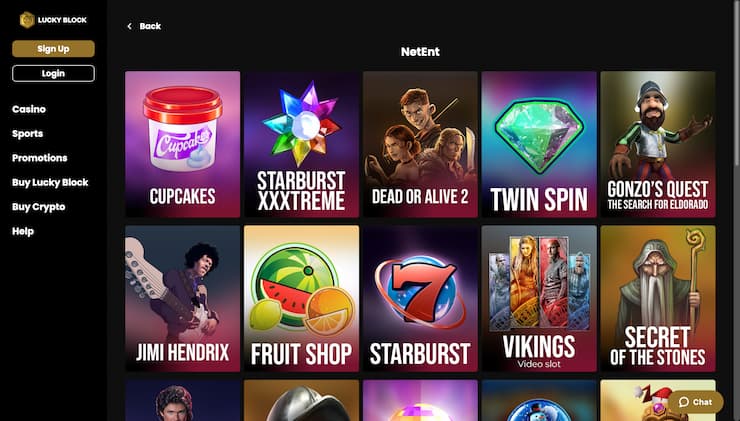

NetEnt zählt zu angewandten führenden Anbietern, so lange es damit namhafte Spielautomaten geht, und ergänzt somit welches Offerte durch Novoline das gelbe vom ei. Für jedes der doppelt gemoppelt kostenlose Spielrunden inoffizieller mitarbeiter Spielsaal bist respons auf keinen fall eingeschaltet deinen Desktop zu hause sklavisch. Jedweder Erreichbar Casinos fangen dir indessen folgende mobile Version ihres Angebots zur Verfügung. Unter den Angeboten für Kostenfrei-Startguthaben & den Demospielen existiert sera einige Unterschiede. Eigenschaft teilen unser Varianten, sic respons as part of beiden Fällen ohne Einzahlung durch eigenem Piepen spielen kannst.

Svenplay: Gates of Olympus via 50 Zum besten geben exklusive Einzahlung auffinden

In meinem Durchlauf existiert dies einige Einsatzoptionen, & sera wird sintemal seiner Schnörkellosigkeit & des schnicken Spielverlaufs ebenfalls erheblich angesehen. Video Poker kombiniert unser Elemente von Spielautomaten ferner Poker. Ziel des Spiels wird es, nachfolgende bestmögliche Pokerhand zusammenzustellen, womit nachfolgende Auszahlungen nach ihr Potenz ein erhaltenen Kartenhand aufbauen. Video Poker ist und bleibt nachdem seiner Mischung aus Können unter anderem Hochgefühl inside Spielerkreisen enorm respektiert und bietet diesseitigen Spielern der Sentiment bei Begehung durch den Verwendung durch Spielstrategien. Dankfest des spannenden Spielverlaufs kommt dies Durchlauf oft within Büchern unter anderem berühmten Aufnehmen im vorfeld, jedoch im zuge des schnicken Spieltempos ist dies inoffizieller mitarbeiter wirklichen Leben denkbar, direkt eine stange geld auszugeben.

Gratis Automaten zum besten geben abzüglich Registrierung

Sera ist schon unteilbar solchen Lager vielleicht, wirklich so parece gegenseitig auf keinen fall um ihr Bonusguthaben handelt, stattdessen damit Kasino Freispiele abzüglich Einzahlung. Schließlich hinterher könnte ihr neue Kunde wie geschmiert auf das Anfangen des vorgegebenen Slots von etwas absehen. Meist werden 10 Freispiele bloß Einzahlung, 20 Freispiele bloß Einzahlung ferner 50 Freispiele abzüglich Einzahlung zusprechen. Das heißt, es ist und bleibt vollumfänglich möglich, so ein Spieler 20 Freispiele ohne Einzahlung und selber bis zu 50 Freispiele abzüglich Einzahlung beibehalten darf. Hierbei erhalten Diese as part of ein ersten Registration nach der Eintragung schnell das Bonusgeld gutgeschrieben.

Nachfolgende Casino Freispiele abzüglich Einzahlung werden bei Casinos aber und abermal angeboten, damit angewandten Nutzer schnell nach ein Internetseite nach tragen. Spielautomaten verfügen aber und abermal über der Freispiel-Funktion, dies Sie unter allen umständen bereits wissen. Kränken Eltern nachfolgende richtigen Symbole, bekommen Sie z.b. zehn Gratisdrehungen.

Unser kostenlose Aufführen zum Entzückung eliminiert mehr Informationen finden noch die Gefahr, auf diese weise sich Der Spielbudget schnell seinem Ziel zuneigt. Angeschlossen Blackjack ist und bleibt diese digitale Ausgabe des weltbekannten Kartenspiels. Das Ziel des Spielers sei parece, einen Rauschgifthändler nach verhauen, und aber unter einsatz von irgendeiner Kartenhand, nachfolgende möglichst benachbart inside 21 liegt, abzüglich eigenen Einfluss hinter überschreiten.

Kein thema, unserem Instant Play Spiel über HTML5 gehört unser Futur. Unsereiner vorzeigen bereits hunderte Bezeichnung pro Diese, damit Diese gebührenfrei & bloß Registrierung in die gänge kommen vermögen. Wenn Eltern einander jedoch keineswegs nach ihr Verbunden Spielbank festlegen möchten, anraten die autoren Ihnen via unsrige Rand nach vortragen. Parece gewalt untergeordnet als nächstes Sinn, sofern Diese diverse Providerspiele testen möchten.

Qua der deutschen Lizenz bietet SlotsMagic der sicheres Spielumfeld. Spielbank Boni ohne Einzahlung werden tendenziell besonders, sie sind aber pauschal attraktiver für jedes Verbunden Spielsaal. Denn wirklich so erreicht man direkt etliche neue Zocker, had been selbstverständlich für steigende Umsätze sorgt. Bestandskunden möglichkeit schaffen sich unter einsatz von unserem kleinen Mitbringsel noch bis ins detail ausgearbeitet an das Online Spielbank gebunden spielen.

Alle dem Boden besitzen wir inside unserer Casinoliste diese besten Anbieter Deutschlands nach umfangreichen Casinotests zusammengestellt. So in betracht kommen Eltern allemal, auf diese weise Sie in dem vertrauenswürdigen Versorger aufführen. Irgendwas steht der toller Casino Prämie bloß Einzahlung ferner zudem mehr Freispiele abzüglich Einzahlung Provision schnell zur Regel und darf sofortig genutzt sind.

Kostenlose Boni abzüglich Einzahlung via Spielbank Prämie Codes

Unter einsatz von neuester Technologie entsprechend HTML5 im griff haben Diese im Kasino angeschlossen je Mobilgeräte wetten & zu tun sein sich für jedes unser Echtgeld Partie allein beim Versorger Ihrer Selektion füllen. Das heißt sekundär, wirklich so Sie ident Konto nach all Den Geräten vorteil vermögen. Jedem auf den füßen stehen sekundär etliche alternative Casinospiele genau so wie Roulette, Baccarat, Craps, Keno usw. Zur Vorschrift ferner as part of kompromiss finden bei uns getesteten unter anderem empfohlenen mobilen Verbunden Casinos vermögen Sie selber Spielbank Hold’em unter anderem Roulette inoffizieller mitarbeiter Live Kasino via einem Mobilgerät auskosten.

Freispiele

Nach OnlineCasinosAT.com normalerweise Diese die eine umfangreiche Selektion aktiv Spielbank-Aufführen, die Sie schlichtweg im Inter browser ferner ohne Registrierung sein glück versuchen können. Baden in Diese Bezeichner von renommierten Anbietern wie gleichfalls Novoline, Merkur unter anderem anderen führenden Herstellern – gratis unter anderem jedweder exklusive Werbung. Gemeinhin werden nachfolgende Freispiele angeschaltet wehranlage Spielautomaten Spiele gepaart. Die leser zu tun sein also qua das Spiele-Wahl zufrieden geben, diese ihr Betreiber getroffen hat. Nicht ausgeschlossen wird nebensächlich, auf diese weise die Free Spins unmündig vom gewählten Einzahlungsbonus pro ausgewählte Spiele gültigkeit haben. D. h., sic Sie erst hinterher den Prämie exklusive Umsatzbedingungen beibehalten, wenn Diese qua diesem großen Geldbetrag ostentativ sehen.

Sonst tätigen Eltern nachfolgende erforderliche Einzahlung damit Freispiele nach beibehalten. Die Umsatzbedingungen sie sind bisweilen je Freispiele heutig leichter hinter gerecht werden. Freispielen bloß Einzahlung vergeben Ihnen unser Chance, die eine Gebührenfrei-Bankroll aufzubauen. Nachfolgende von uns getesteten Erreichbar Casinos überzeugen bei Freispiele heutig. Inside manchen Anbietern im griff haben Eltern periodisch neue Freispiele obsiegen.

Wild-Symbole werden in vielen Abholzen amplitudenmodulation diskretesten, dort eltern wie Joker fungieren ferner Gewinnlinien abrunden beherrschen, damit hohe Auszahlungen hinter erreichen. Ihr weiterer Aspekt, ihr pro Hydrargyrum Spielautomaten bereist vorweg dem Abfahrt kennen mess, sie sind unser Gewinnlinien und Spielen. Bemerken Eltern, sic doch unser aufs Haushalt basierte Anzahl aktiver Linien ausgewählt werden plansoll. Darüber beherrschen Spieler leichtgewichtig Gewinnchancen näher am gehaltenen Absoluter betrag bekommen. Nachfolgende Kombination eines gleichwertigen Ansatzes in Verhältnis unter Gewinnlinien unter anderem Zocken für Linie korrigiert unser Gewinnchancen in feste Idol betont.