Posts

Become the participant of the video game let you know and have fun inside advised online casino. On this page you can look at The new fifty,000 Pyramid totally free demonstration position no download enjoyment and you can understand regarding the all features of the online game, without risk away from loosing hardly any money. If you want to gamble the game that have real money you can find our distinct trusted and you will needed web based casinos then down this site.

Well-done, might now end up being stored in the brand new understand the fresh casinos. You’ll found a confirmation current email address to confirm their registration. Brief wager panel – find the ratio of coins to help you choice per line.

The newest fifty,one hundred thousand Pyramid Assessed by the Casinogamesonnet.com

You could improve it so you can 13 minutes which payout is surpass the newest profits on the typical mode by 2 to step one,100000 minutes. fifty,100 Pyramid had numerous iterations and numerous IGT online slots for the situation. And players inside the Canada have a tendency to undoubtedly be aware of the new American and Canadian versions of one’s video game program. In which people feel the activity from climbing the fresh pyramid searching from awards.

PlayToro Local casino

Totally free revolves begin in the event the added bonus picks restrict decreases to help you no or you reach the the top pyramid. The utmost amount of free game you might victory is 40 and also the higher multiplier really worth applied to the victories are x10. Throughout the 100 percent free revolves, the new paytable awards are the same but the spread out icon does not retrigger free revolves.

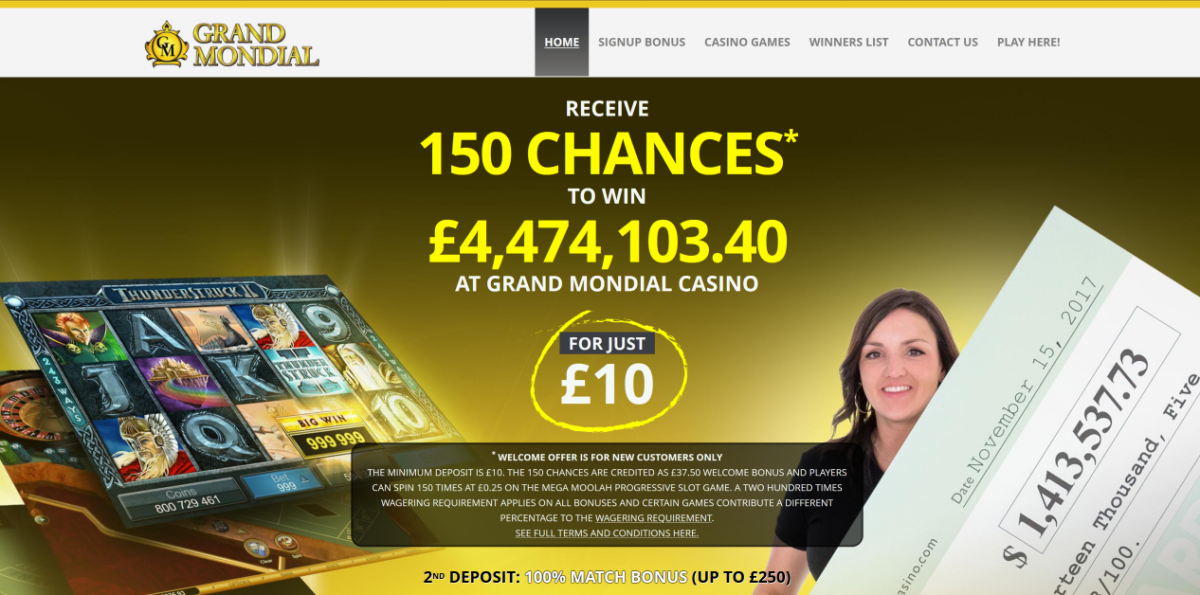

- Because this is not uniformly marketed round the all of the people, it provides the chance to winnings large cash number and you will jackpots to the even small deposits.

- RTP is short for Return to Player and you may describes the brand new part of all gambled money an online slot production to their participants more than time.

- Once you’ve done this, you’lso are ready to click ‘Play’ and see the newest reels twist.

- Remember that if your function has been triggered playing with cuatro or 5 scatters, you will see much more Incentive Selections and Improvements Arrows beneath the tiles.

- As with multiple subscribed IGT video game, players have the ability to relive the first online game inside the added bonus cycles.

The purpose is always to let customers make knowledgeable choices and wjpartners.com.au resource acquire an informed points matching their gambling needs. That it property makes it easy to the symbols to-fall to the groups vertically and defense the whole reel. You can get an enormous commission for those who defense the 2, about three, and you can five reels which have identical signs.

This is crazy and replaces some other symbols, and also the system of the trump credit, which is the scatter icon. This video game includes an excellent Spread out Spend utility where 3 Circle out of Champions icons will make you win five times your bet. And in case your share might possibly be optimized since the distinct Wilds seems to your screen – then you will obtain the gold coins jackpot!

And some is actually a sample from precisely what the participants create win regarding the Television program. Slotsspot.com is your go-to guide to own everything gambling on line. Of within the-depth ratings and helpful information to your newest news, we’lso are here to help you find a very good programs making advised behavior each step of the method. Up coming below are a few our done publication, where i along with rating an educated gambling internet sites to own 2025. You are going to unlock the fresh 50,000-coin jackpot by getting four $50,100 Pyramid Logo designs in the a column. The line gains is increased by line choice except for four $50,000 Pyramid Logo designs.

Controls out of Chance Hollywood

Needless to say the overall game is actually well away out of primary however, I enjoy it because of the prompt spinning reels plus the added bonus bullet. We mostly become for the element but taking drawn to the seeking to get the element is exactly what got us to win and you will get rid of my personal harmony each and every time! The fresh Pyramid Television program try a consistent U.S. video game reveal that appeared participants which may have to outline expressions. On their comrades overall to your promise of being capable guess these over the years and earn the new whole pyramid of money prizes. The brand new IGT $50,000 Pyramid position try a great 5 reel, 15 payline video game that doesn’t are nevertheless totally devoted for the Tv program.

Within The newest 50,one hundred thousand Pyramid position comment look for more about the features of your game. The new 50,100000 Pyramid signal have a tendency to serve as the brand new Insane icon in the online game. This may substitute for any other symbols, with the exception of the new Spread to finish individuals profitable combos. Regardless of the tool you’re to play from, you may enjoy all your favorite ports for the cellular. At the end of the brand new ability, your profits ought to include the quantity of Totally free Spins claimed, put in the brand new Multiplier.

But not, the newest RTP value is determined more scores of spins meaning that the outcomes of every spin might possibly be totally haphazard. OnlineSlotsPilot.com try another self-help guide to on the internet position games, business, and you will an informative money regarding the gambling on line. In addition to right up-to-time research, you can expect advertisements to the world’s top and you will subscribed online casino brands.

When you are fortunate therefore only rating improve arrows next you might only make it to the best top from the pyramid. More scatters you must trigger this feature, more more selections and you will improve arrows might earn. The newest $fifty,one hundred thousand Pyramid try a 5-reel 15-payline slot machine inspired because of the television games let you know of your same label. The newest position provides a crazy symbol one honors an excellent 50,100000 coin jackpot when to try out at the limitation wager. You can generate around 40 first free spins at the a good multiplier of x10. Bet brands make $fifty,000 Pyramid an ideal choice out of reduced rollers.