Work-existence equilibrium ily, particularly if you are a leading-artist at your profession. Its burdensome to look at your own students grow up and never enjoy high quality go out with them as you learn you ought to. This will be an informing signal order your basic trips property.

When you very own your own trips house, experiencing the coastline, walking, or any other leisurely activities is actually. Your throw out the effort of finding readily available bookings because of the driving to a gentle domestic your already very own.

In order to be eligible for a great vacation assets mortgage price, you will find several requirements to meet up. Your own never ever-finish vacation are waiting for you. This is what you need to know on the vacation home mortgage conditions for taking the new diving.

How will you Make use of the Family?

The manner in which you plan to have fun with a property find the fresh new purchasing process and you will specific loan conditions. You’ll find step 3 classes your residence can get fall under: first, additional, otherwise investment property.

Being aware what types of house your vacation property will direct you shifting that have a skilled lender. They are able to set you right up to your ideal financial and you can lower rates which means you as well as your kids is invest top quality time to each other.

First House

I identify a primary home since the family you reside for most the season. Generally, mortgage interest levels may be the reasonable of step three home classes.

What’s needed for qualifying to payday loans online in Compo Connecticut have a primary house mortgage try and lower than other kinds of residences. As an instance, you can get a first house or apartment with a down payment because reduced just like the step three%, and your obligations in order to earnings ratio is highest.

Loan providers promote these advantages because they trust they take on faster risk whenever financing to possess a primary household. During the economic setback times, borrowers be a little more motivated to pay money for the latest roof below and that it alive than many other types of residences.

Second Home

A secondary home is property you reside for cheap than simply a lot of the year. You really have nearest and dearest and you may associates that really work towards other shores or that accumulated snow bunnies you to definitely alive right up northern but invest its summertimes for the more comfortable climates. Really trips property fall into the brand new additional residence group.

Whenever capital an additional family, certificates differ from a primary home. The main marker is you don’t use FHA or Virtual assistant Household Fund to fund this type of functions. At the same time, credit rating and you can loans to earnings proportion requirements are stricter.

It ensures the financial institution was trying out a secure amount of risk to stop defaulting to the mortgage loan. Needed a top down payment to possess travel land bought you to definitely was additional houses.

Money spent

If you buy a house on the aim of renting they aside for rent earnings, we might think about it an investment property. These may be a lot of time-name renting otherwise vacation rentals, such as for example Airbnb’s otherwise VRBO’s.

Funding features differ from first and you will secondary homes that have assets taxation and you will deductions. You should also know that financing criteria can vary that have travel property contained in this classification.

As an instance, money home need higher down repayments but all the way down credit ratings. The lending company may require you to definitely have cash on hands in order to coverage six months out of mortgage payments just before they will certainly give so you can you too.

Avoid Trips Home Swindle

We believe you must know that classifying a rental family since the a secondary home is con and certainly will trigger significant legal outcomes. Which makes reference to your perfect travel domestic if you call it a residential property whenever most its a summertime getaway.

However, you are able to classify your vacation assets once the a second family if you’re in it over 14 days per year or ten% of your own days it is rented. A talented realtor should be able to clarify questions to you personally inside world.

Now you know if the trips home classifies because the good second house or accommodations assets, you ought to determine how you are going to loans the acquisition.

Banking institutions much more liberal using their financing techniques to possess top homes, but that does not mean youre ineligible having lowest mortgage loans.

Of numerous opt to gain a deposit having a vacation home which have a profit-out re-finance of the top home loan otherwise securing property security line of credit. Doing this works well because the a top advance payment hinders highest interest rates and guarantees lower monthly obligations.

Would you Meet up with the Mortgage Standards?

Vacation lenders cover anything from financial so you’re able to lender, whether they is a talented private bank otherwise a bank. I encourage contacting multiple activities to see who will bring personalized solution and you can financing what you want getting a holiday assets.

- Debt so you’re able to earnings proportion up to 43-45 percent.

- Credit rating a lot more than 640

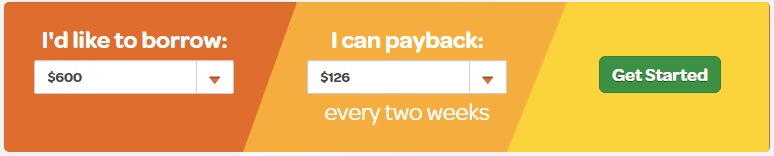

- Minimal 10% down-payment

- Put aside out of 2-6 months mortgage repayments

For those who see these certification, you are ready to begin with visiting the right way! Usually do not spend any longer of time and energy finding method exclusive accommodations. As an alternative, finish off your own bag and you may venture out to your individual vacation property.

I specialize in finding the best mortgage option for you. Don’t get worried about learning the brand new particulars of trips mortgages oneself. We have over that work for your requirements and will identify all of mortgage possibilities step-by-action.

E mail us today from the (480). to inquire about all your concerns. Begin your fascinating travels on the buying your dream trips domestic now!