Blogs

It is extremely possible that you are able to obviously move for the a minumum of one application team, which might help you narrow down the brand new internet sites we should try. Since the label means, such added bonus provides players a small amount of cash to use from the dining tables without the need to generate a great put of their own. Don’t confuse them with freerolls, that are competitions with dollars prizes you to definitely professionals can also be go into to own totally free. Caribbean Stud Web based poker features fixed winnings and simple tips – including increasing for the moobs or best. Throw a modern jackpot on the combine, along with your self a superb web based poker game worth to play. Yes, for many who gamble slots the real deal currency, you could potentially win real money awards.

- Casinos on the internet is committed to creating in charge gaming and you can getting people to the systems they need to remain safe.

- The sole solution available to professionals within nation are to access global internet sites to experience.

- All the ships provide local casino gambling immediately after entering international oceans.

- The fresh Dominican Republic has much more gambling enterprises than just about any most other Caribbean country along with 29 located in regarding the several some other towns.

- The newest Grand Palladium Bávaro Suites Resort & Spa has a casino and an almost all-comprehensive ambiance regarding the Dominican Republic.

Casino Betfred registration | Vulkan Spiele Is more than a casino

If you are belongings-founded playing are an elaborate issue within the North Korea, in just people allowed to gamble, as well as on an incredibly controlled base, the state of online gambling is a bit vaguer. Currently, this is not clear whether or not citizens are allowed to enjoy on line. An online lottery web site can be found, called, DPRKLotto.com, that is the original in business within the North Korea. There are no legal gambling enterprises inside the Turkey, however the really-heeled, adventurous traveler may still see a number of “individual nightclubs” within the Istanbul. But not, the newest Jockey Club out of Chicken counts more 5,000 effective race horses plus 2015 plans were from the works to build 23 the fresh pony tunes along with the 9 established next. To gain access to a list of current pony race and you may gaming spots in the Chicken excite discover Pony Racing Tunes in the Turkey.

Caribbean Stud web based poker video game

The new Betpawa web site and you can cellular app are safe for playing. By the registering on the site and setting sporting events wagers, profiles make sure he could be at least 25 years dated. The organization supplies the authority to ensure age and personal information of all of the people. Given the i have safeguarded, I would suggest beginning with the new $5,100000 welcome bonus from the Insane Casino. The fresh BetSoft Caribbean Stud Poker game is great for the pc otherwise cellular, and very flexible in terms of betting limits.

Online casino games: Fundamental Categories and features

To conquer the new dealer’s being qualified hand, you will have to features a healthier poker hand. Lower than is the steps of give to own on line Caribbean Stud web based poker. Along with, if you’ve hit a top give, including a regal Flush including, plus the agent didn’t meet casino Betfred registration the requirements, your obtained’t receives a commission out to suit your Phone call choice. As previously mentioned, Caribbean Stud Casino poker features a few additional paytables – you to basic plus one to the progressive jackpot front side bet. To start with, we will show you the conventional paytable, which is the one which often overwhelmingly be in gamble while in the their Caribbean Stud Poker online game.

- That is an exciting and you can fun all of the-inclusive resorts to possess people merely and a perfect spot for a personal trips with your companion.

- The age restrict to help you gamble in the gambling enterprises inside the St. Maarten is actually 18 years old.

- Whenever Russia banned gambling enterprises last year, before setting up and you may populating gaming zones starting with the newest in the near future so you can end up being defunct Azov-City inside Rostov Oblast, Russians swarmed in order to Minsk to enjoy.

- Political leaders provides discussed setting up gamble so you can residents but the idea is usually dashed with very little next talk.

- If your agent’s hand doesn’t be considered in the Caribbean Stud poker, then you’ll discover an apartment payment of 1 to 1 in your ante bet, and also you’ll get your increase wager returned to your.

- Of several overseas businesses believe that they’re going to undertake bets regarding the Cayman Islands.

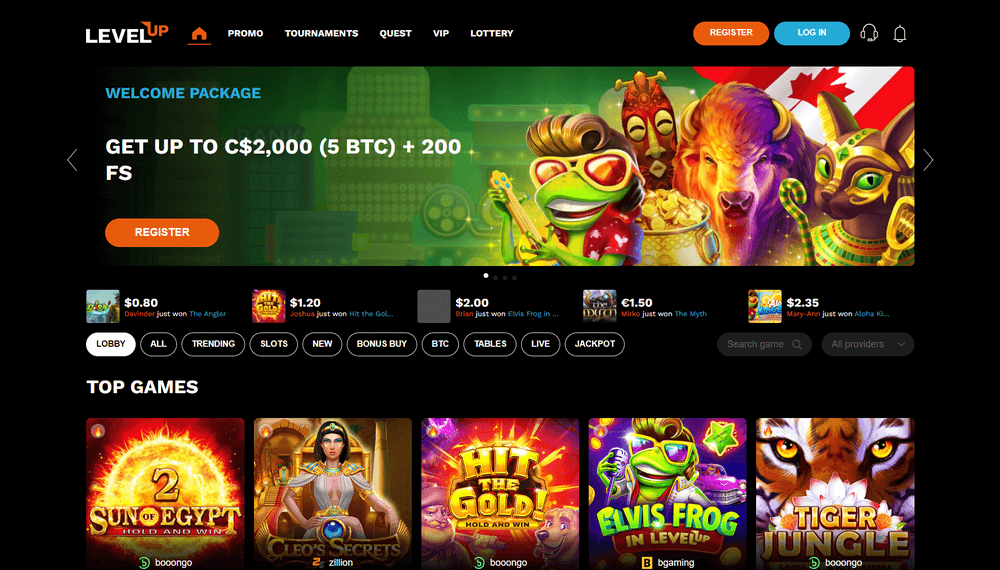

Best Web based casinos to have 2025

Gaming inside Norway is mostly an unlawful activity except under certain items. The government retains a gambling dominance thanks to a few organizations. Norsk Tipping offers wagering, Keno, scratch notes, and you will a lotto draw video game. Web based poker game in the home are allowed beneath the law so long since the games will not perform because the a business. All the true slots was banned inside 2007 and you may changed because of the IVTs (interactive video terminals) during 2009.

Since the ports away from phone call alter many times attempt to find up-to-the-minute guidance to help you publication a sail. The brand new poker scene inside Main The united states is actually to help you transient so you can establish, however for more area, your very best wagers are San Jose within the Costa Rica and you can Panama Urban area. Query before going or ask around when you are getting indeed there, however, follow the authorized rooms, within the top quality casinos to stay to the secure side.

Oceania Cruise trips revealed the very first vessel within the 2002 and you will already provides a fleet from half a dozen ships. Centered by a group of cruise globe pros, the organization is actually obtained from the Norwegian Cruise Line Holdings, LTD inside 2014 in addition to a cousin business, Regent Seven Oceans Cruises. The new cruise line is very preferred and continuously adds to its fleet.