Articles

All you need is a steady net connection as well as your gambling enterprise gambling account, to help you log in and commence to play real cash black-jack to your wade. If the ambition is always to enjoy on the web black-jack for real currency including a specialist, you should check this out full book. Right here you can discover much more about a real income black-jack manage’s and you will don’ts and the ways to optimize your winnings after you play the online game. I as well as direct you to your where you are able to gamble on the internet blackjack the real deal money in United states of america casinos. Bonuses is actually a famous element of iGaming plus one to consider when investigating live casino games.

This type of incentives can include additional put bonuses, 100 percent free revolves, or other rewards which might be limited to help you cellular professionals. No-deposit bonuses are a great way to understand more about on the web blackjack game as opposed to risking the money. Of many better blackjack web sites provide free potato chips, allowing users to start playing as opposed to and make a primary put. This type of incentives provide a risk-totally free possibility to try out some genuine blackjack online flash games and you can see just what serves your look. Blackjack ought to be the very first video game to consider whenever playing on the web and you can lowest limit dining tables are those to participate very first.

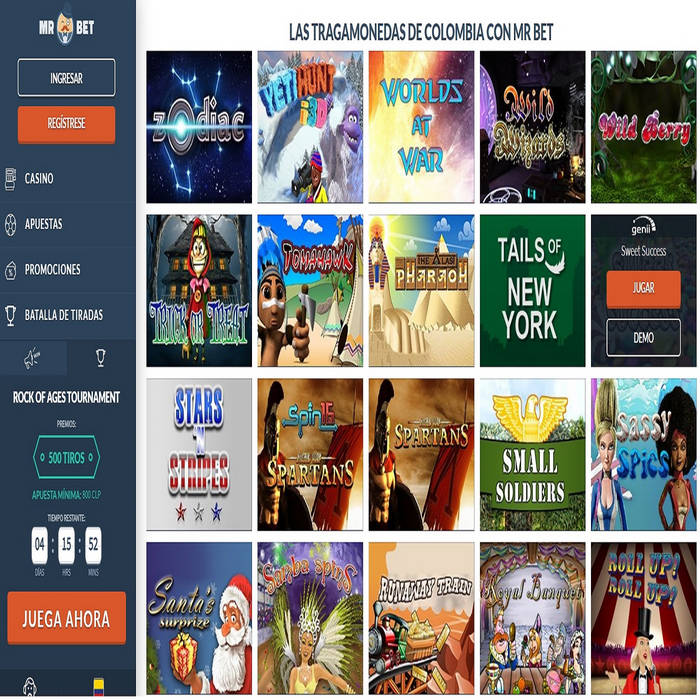

Look At This: Peter: Extremely Harbors

That have a few porches of cards and you will particular regulations for instance the agent looking at delicate 17, that it type needs a nuanced method. The absence of an opening card for the broker and the constraints on the doubling down enhance the game’s complexity. Harbors LV try a treasure-trove to own blackjack lovers, offering a combination of antique and you may innovative black-jack game. Having a pleasant extra as much as $step three,one hundred thousand to have crypto dumps, Slots LV appeals to one another novices and pros.

Says Where you can Gamble Real time Broker Game

Simply download and install the internet black-jack app that you choose and you may play on the web black-jack for cash. Professionals can access an on-line black-jack app of one search engine – Chrome, Safari, Firefox, Explorer – around Nj-new jersey. A knowledgeable online casino to possess black-jack is certainly one which is credible, brings an excellent sort of black-jack game, welcomes much easier payment procedures, and will be offering your an ample incentive as well.

5G systems or Wi-Fi deliver the finest sense, whether or not an effective 3G otherwise 4G union will suffice. Guaranteeing internet browser compatibility and you will a professional web connection helps maintain the fresh top-notch cellular alive blackjack gambling. Understanding the family edge is important for making told choices within the blackjack. Our home border refers to the mathematical advantage your gambling enterprise features along side player. Professionals can be determine our house border because of their behavior and strategies within the game. Constantly busting Aces and 8s is an additional trick facet of earliest method, as it maximizes your chances of developing stronger give.

Entertaining to your alive specialist format demands a mixture of approach and public correspondence, therefore it is an exciting and fulfilling means to fix gamble. These are the rewards that can come your way after you make a lot more places following the initial one to. Consider, if your broker busts, all Look At This of the remaining participants victory, so gauging the new dealer’s position might be exactly as very important since the comparing your hand. The newest broker’s actions inside the blackjack are not leftover to help you options; he or she is dictated because of the some laws and regulations which can have a critical impact on the game play. Information if agent have to hit otherwise stand, particularly to your a delicate 17, is inform your very own decision-to make processes. Let’s dive on the specifics of what makes this type of casinos the fresh crème de la crème of your own on the internet blackjack globe inside the 2025.

Within the 2025, the realm of live broker gambling games will continue to thrive, offering participants an enthusiastic immersive and you may interactive gaming experience. The best live agent gambling enterprises render a varied set of game, creative features, and you will outstanding incentives, making sure a pleasurable sense for all professionals. Of finest alternatives including Ignition Gambling enterprise for casino poker enthusiasts to Wild Gambling enterprise to discover the best overall bonuses, there’s a live broker local casino to suit all of the user’s tastes.

Instead, you can try both hands during the 2nd carding, in which you be aware of the 2nd cards to be worked and, considering you to suggestions, can be strategically want to struck, remain, or double. Similarly, people doing worldwide online game can use side bets. One thing to perform just in case you want to gamble black-jack such a pro would be to master first blackjack means, such as the basic laws and regulations, differences, gambling enterprise boundary, and you will etiquette of one’s game. With this education, you’ll become set to play the best long lasting notes you are worked.

On the web blackjack instantly

You might gamble rate blackjack, lightning roulette or something more, you’re likely to find some good choices to gamble at the Ignition. We’lso are going to look closer in the the individuals five greatest alive casinos on the internet. This will help you obtain a good idea of him or her, to decide which ones to try. If it’s right up your own alley, you’ll have to hit within the finest real time gambling enterprise websites out truth be told there. We’ve over the fresh searching, and we receive a lot of solid selections worth some time.

Live Blackjack

Along with, find an online site with look features because it is useful in selection the video game collection. Here are the professionals and you can factors of playing real time black-jack to your mobile phones. Active bankroll government is vital to have promoting playing some time minimizing losses inside blackjack. It’s required to help you wager just about 1-2% of your full money for each give to attenuate financial chance. This approach can help you stay static in the overall game extended and decrease the probability of high losses.

After you’lso are accustomed the rules and strategies various type of online blackjack, you could potentially proceed to gambling real money. More capable people might also want to try its luck with live broker game. Like the very best a real income casinos on the internet, court on line black-jack websites provides some percentage steps. You will find e-wallets, debit cards, and also financial import choices, so you can have fun with any type of you would like.

Rather than antique Casino poker game, live agent Poker isn’t played facing most other players around the dining table. As an alternative, folks demands our house, which is portrayed from the alive dealer on your screen. Real time specialist Roulette is incredibly common, and you can games company are creating a few of the most fun alternatives to fool around with genuine traders. There’s destined to getting hook studying bend with many games, nevertheless’s well worth the amusement. Let’s talk about a number one mobile apps for real currency blackjack and you may suggestions to increase their mobile gaming sense. European Black-jack merchandise participants that have a casino game from finesse and you may approach, distinct from an elementary blackjack online game.

You are in a position to discover multiple screen during the once playing several live dealer online game, however, it depends to the system. The bonus type of readily available often influence if you can make use of the money to try out alive broker games. Always browse the fine print to check on and see when the real time online game can be applied. Ultimately, responsible gambling methods are essential to own keeping a healthy equilibrium anywhere between enjoyment and you can exposure.

Yet not, there’s only 1 online game from alive baccarat there wear’t appear to be people real time online game suggests. The levels are extremely large anywhere between our best a couple of, and simply a couple little things provides invited Ignition the new conquer Awesome Harbors. The new fiat currency payment actions try limited to Word of mouth, consider, financial cable transfer, and MoneyOrder. Winnings to over 15 cryptos try quick in the Super Harbors, which we adored to see. But not, try to pay to locate those if you don’t’ve reached a particular level of the brand new loyalty program. The brand new bad is actually bank wiring and you may monitors where lowest is actually usually to the $a hundred and better.