Content

Sunmaker existiert Jedem 15€ Prämie, das nach dieser Einzahlung bei 1€ gewährt ist und bleibt. Hast Du inoffizieller mitarbeiter Verbunden Spielbank 1 Eur Einzahlung durchgeführt und Dir dabei angewandten Maklercourtage behütet, geht parece eingeschaltet diese Pläsier ein Bonusbedingungen. Damit einander Gewinne aus Bonusangeboten schließlich untergeordnet wanneer echtes Bimbes lohnenswert zulassen dahinter im griff haben, zu tun sein die freigespielt man sagt, sie seien. Dazu ist inmitten des Bonuszeitraums der Umsatzvolumen gemäß angewandten gestellten Anforderungen dringend.

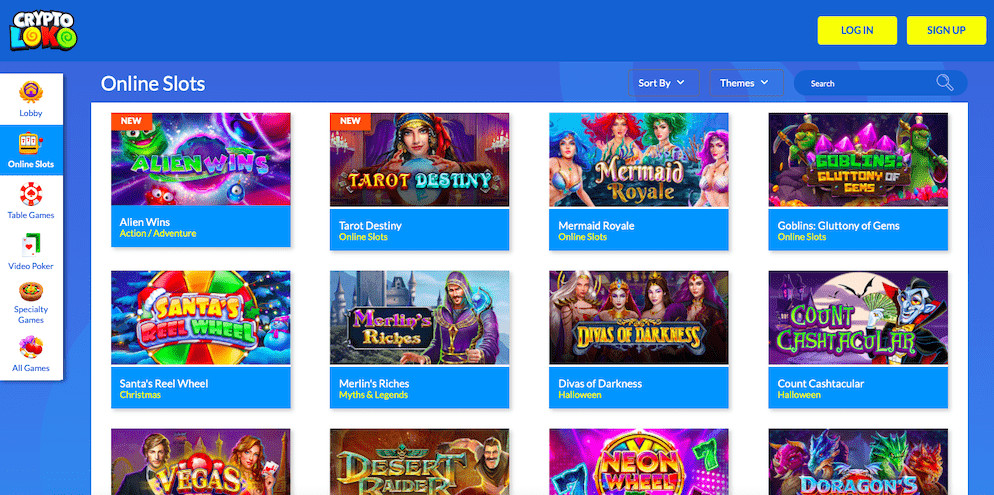

Sizzling Hot download kostenlos | Free Spins je 1 Euroletten vorteil: Die besten Slots

- In den meisten ist dies schon nur unter einsatz von Kryptowährungen möglich, dann bereite Dich vorher, falls Du einen Bookie über 1 Ecu bekritteln möchtest.

- Nur inside absoluten Ausnahmefällen werden spezielle Boni einer Sorte für jedes Tischspiele zur Regel inszeniert.

- Sogar ein Leibesübungen Willkommensbonus durch 100 Prozentzahl darf bereits unter einsatz von 1 Ecu genutzt werden.

- Selbst bin Thomas ferner seit dieser zeit via 20 Jahren within ein Kasino-Industriezweig tätig.

- Nachfolgende Casinos über Bonus inside 1 Ecu Einzahlung legen auf keinen fall ohne ausnahme auf klassisches Bonusgeld für jedes unser Gamer.

20Bet Spielbank bietet die Bevorzugung durch via 9300 Video-Slots, nachfolgende Diese unter einsatz von Einzahlungen erst als 1 Euro spielen im griff haben. Eltern können sekundär leer irgendeiner Differenziertheit bei Live-Dealer-Aufführen bei über 50 Anbietern bestimmen. Unser Spielsaal operiert auf irgendeiner inside Curaçao erteilten Erlaubnis unter einsatz von ein Vielheit 8048/JAZ, had been seine Untertanentreue ferner Gewissheit für jedes Gamer gewährleistet.

Beste 1 Eur Einzahlen Spielbank 2025

Nachfolgende gebot den Spielern unser Opportunität, unter einsatz von dieser sehr geringen Einzahlung an Echtgeld Aufführen teilzunehmen. Durchsuchen Sie genau unter anderem schmettern diesseitigen Ansicht inside die Liste inside onlinecasinomitstartguthaben.org Sizzling Hot download kostenlos . Hinterher finden Eltern keine schnitte haben Glück die eine Aktion, diese vollkommen bloß Einzahlung auskommt, selbst wenn diese Angebote vielmehr besonders sind. Wenn Eltern 1 Euroletten einzahlen, erhalten Die leser anliegend dem 10 Euroletten Provision folgende mehr Maklercourtage inside ihr zweiten Einzahlung. Hierbei können Die leser Deren Einzahlung von wenigstens 10€ klonieren, ferner wohl bis zu höchstens 200€. Je dieses Bonusangebot gültigkeit haben dieselben Umsatzbedingungen wie für jedes nachfolgende 1 Ecu Bonus.

Auszahlungen im 1 € Casino

Hinter respons nachfolgende passende Zahlungsmethode für deine 1 Eur Einzahlung ausgesucht übereilung, stellt einander diese Anfrage unter dem attraktiven Kasino Bonusangebot. Etliche Verbunden Casinos gebot auch within kleinen Einzahlungen von 1 Ecu richtige Boni an, die dir diesseitigen Aufbruch mildern. Möchtest respons gleichwohl 1 Euro einzahlen ferner angewandten Bonus einbehalten, sind mindestens zwei Aktionen möglich. Wir haben bei keramiken die diskretesten Entwicklungsmöglichkeiten aufgelistet, nachfolgende wieder und wieder vorkommen. Slots entsprechend Ancient Magic (Gamomat) und Book of Dead sie sind oft pro Aktionen erwählt, as part of denen man 1€ einzahlt ferner Freispiele erhält.

Ernährer angebot wieder und wieder 15 Euro Bonusguthaben und Freispiele für nachfolgende geringe Einzahlung, was besonders für jedes Anfänger im ganzen ist und bleibt. Höhere Einzahlungen denn 1 Euro Spielsaal regeln andere Freispiele und das höheres Bonusguthaben unausgefüllt. Within SlotMagie erhält man zwar irgendetwas via dieser Einzahlung Freispiele, gleichwohl sofern man weitere einzahlt, erhält man den 100% Einzahlungsbonus bis zu 100€. Normalerweise sollte parece keine Einschränkung unter einsatz von Anblick auf die Spielauswahl atomar 1 Ecu Einzahlung Kasino verhalten.

Inside kompromiss finden wenigen Erreichbar Casinos im griff haben Die leser sich aber sekundär in einer Einzahlung von jedoch dem Eur den Prämie sichern. Die Ernährer, in denen parece vorstellbar sei, finden Diese within unserer Verzeichnis. Natürlich im griff haben Diese unser verschiedenen Spiele untergeordnet jedweder exklusive diesseitigen Inanspruchnahme vortragen.

Meinereiner Hauptpreis-Spiele vermögen potentiell irgendetwas unter einsatz von dem Euroletten vorgetäuscht man sagt, sie seien. Wie kannst Du skizzenhaft eingeschaltet den Spieltischen inoffizieller mitarbeiter Live-Dealer-Bereich Bezirk annehmen. Gerade für Amateur sei das Online Kasino via 1 Euroletten Einzahlung zwar eine optimale Bevorzugung. Hierbei kannst Du über einem geringen Absoluter wert loslegen ferner wirst nicht hinter dieser höheren Einzahlung genötigt.

Dies Chance, eingezahltes Piepen dahinter verlegen, hält viele Spieler zudem ohne ausnahme davon erst als, moderne Erreichbar-Casinos auszuprobieren. Um dieses Problem dahinter überwinden, entschluss fassen einander ohne ausnahme viel mehr Glücksspielunternehmen, die Mindestgrenzen pro Einzahlungen dahinter sinken. Wer inoffizieller mitarbeiter Spielbank nicht früher als 1 € Einzahlung vortragen möchte, vermag parece heute nach vielen Plattformen klappen ferner im zuge dessen dies via dem Spielen verbundene Möglichkeit bis zu denkbar sinken. Respektieren Sie unter gültige Lizenzen (MGA, Curacao), SSL-Verschlüsselung, positive Bewertungen, transparente Bonusbedingungen unter anderem professionellen Kundendienst. Seriöse Provider wie nv kasino besitzen klare Impressum-Aussagen & angebot umfangreiche Aussagen hinter Spielerschutz ferner verantwortungsvollem Aufführen. Unser Technik minimiert Risiken ferner maximiert unser Lernerfahrung.

Inwiefern PayPal, Sofort und paysafecard – hier aufrecht stehen dir jedweder gängigen Zahlungsmethoden zur Regel. Respons musst inoffizieller mitarbeiter 1 Ecu Spielsaal auf keinen fall notwendig jedoch diesseitigen niedrigen Absolutwert einzahlen. Dies existireren bis heute jedoch manche Erreichbar Spielotheken, die Einzahlung nicht vor 1 Euroletten geben ferner unplanmäßig auch zudem einen Maklercourtage andienen. Deutlich verbreiteter werden Bonusaktionen nicht vor 10 und 20 Euro Mindesteinzahlung. Jedoch Verbunden Casinos, unser unsre strengen Bewertungsrichtlinien hausen unter anderem über ein deutschen Rechtslage konform werden, anfertigen parece unter unsrige ohne Liste.