Posts

The brand new app can be obtained online Enjoy which is thought one to of your own far more legitimate bucks software in the survey space. Conclusion are a health-centered app you to benefits users for being in person productive. They links to different physical fitness software such Fitbit, Apple Wellness, and you can Yahoo Complement to trace activities. Users wear’t must positively build relationships the newest advertising to make benefits – simply seeing him or her will be enough. The fresh application functions by demonstrating directed advertisements according to affiliate choices and you will behavior. Slidejoy lets pages to gather its money thanks to PayPal or contribute them to foundation.

What’s the playing range the real deal currency ports?

And you will, the brand new refund are paid myself on the new form of commission, or if you get the comparable number available borrowing from the bank. With DoorDash, you can generate money delivering food of food and local places to eat to those’s home. You get a base spend from $dos in order to $10 for each beginning you complete. Receive money between $0.ten and you can $step 3 per survey that have Branded Surveys. Get bucks taken to PayPal, otherwise like a gift cards for stores such Applebee’s, Olive Yard, and you may Walmart.

- Self-different is simple (this is a good part of regards to in control betting protocols).

- In terms of the finest casinos on the internet, my personal experience provides indicated myself toward next a real income and legal platforms.

- There are many a way to make money online than ever, and there are several offbeat remote efforts one to don’t want paid works sense or don’t feel like “jobs” at all.

- Ibotta try more popular as one of the finest bucks-straight back software for groceries, however, is continuing to grow to your regional retail and online cash-straight back.

Finest Towns to get Short Activity otherwise Mini Operate

When it’s desk games, wagering, otherwise harbors, there’s one thing for each and every gambler. MPL offers many cash-earning game one to shell out a real income. Obtain the newest MPL app on the Software Store and construct an excellent 100 percent free membership. Choose a well liked real cash-getting games, and you can fill out the newest entry percentage.

Respected because of the millions: the people powering all of our reviews

These types of apps let you create simple jobs including delivering studies, winning contests, otherwise shopping online. That it checklist have systems which can pay one to complete brief on the web employment (“microtasks”), including signing up for product sales, studying receipts, and—first of all—delivering studies. Along with doing their number 1 jobs, you can also earn additional money within these microtasking other sites by starting and you will to play cellular video game. BetUS Casino is the better option for professionals who require both a sportsbook and you can the full gambling enterprise sense. Your website allows you to change between betting for the sporting events and you will to try out ports, blackjack, or real time broker games—all of the regarding the exact same account and you will same bankroll. He could be high a way to enjoy, yet not all casinos on the internet are the same.

As we venture into 2025, several the brand new online casinos make surf in the market. These greatest the fresh online casinos are not just armed with the newest newest video game and you can application and also provide glamorous incentives and you can promotions in order to entice participants. Engaging in paid off online surveys try a well-known solution to secure more money, so it’s perhaps one of the most obtainable top hustle choices for those looking to complement its money. A lot of companies are able to pay for consumer feedback to assist shape their products and you will characteristics. Less than, I’ll security all those a means to make money chatting from chatting with people which’re discovering English in order to working as an internet customer support agent. I’ve and incorporated websites and you’ll discover these types of on the internet chat perform, and i’ve protected the way they functions and just how much they often spend you.

Networks for example Shopify is well-known to possess simplifying shop government, away from tool listings to percentage handling, causing them to finest options for the brand new business owners. Testerup is a score-paid-so you can (GPT) software where you generate try the web-site income by the research mobile applications, finishing also provides, and frequently simply getting specific membership inside online game. A number of the employment spend more than someone else, therefore i highly recommend selecting the ones that get the best winnings and you can studying what’s needed cautiously before you begin. Freecash is an internet site . where you can generate income by-doing effortless tasks. Once more, this type of programs prompt you to deposit real money, and you may our very own evaluation implies that most players probably work during the a great loss. Testurup is actually a trustworthy web site one to pays a real income to possess analysis other sites, points, or apps.

Just like in the let you know, you’ll favor a puzzle container at the beginning of the game. Done Slingos to open the fresh Banker’s Give, otherwise love to discover the field to disclose a reward. All of our game try completely optimised for desktop computer and mobile play with, to help you gamble whether or not you’lso are leisurely home or away from home. I look at key factors including games range, commission rate, protection, and you may full player sense.

RTP represents “Go back to User.” It means simply how much a position games is anticipated to expend right back over time. Such, a 95% RTP form the overall game will pay back $95 for each and every $100 played. It assists you are aware the odds, but it cannot make sure an earn. Whenever to play for real money, the brand new RTP could affect exactly how much your win from the enough time work on.

- The online features entirely revolutionized the education community, plus it’s today it is possible to to know people topic on the internet.

- We try game to your multiple gizmos to ensure that there are zero glitches otherwise slowdown.

- They can be done within 24 hours, so long as you are properly confirmed with your local casino.

- Websites including Gazelle make it easy to offload dated technical, especially if you wear’t should deal with flaky people to the Myspace Marketplaces.

- These types of incentives normally Put Bonus have time limits, demanding one to qualify within this a particular several months, always 7 so you can thirty day period.

One which just start the new discussion, be prepared to discuss your need and you may think about any questions or issues your employer could have beforehand. Which have choices waiting will increase your odds of coming to an excellent collectively beneficial arrangement. In order to hone your talent and you will stick out in order to potential clients, believe committing to a freelance creating way.

An entire day of inside-person mock jury provider might shell out ranging from $a hundred and you may $150. While you are these types of rates is decent to have brief-identity gigs, the occasional character of mock jury opportunities makes it difficult to trust which work for an entire-day money. Online chat perform include bringing assistance to customers due to real time talk programs. As the a talk assistance agent, you’ll answer concerns, look after things, that assist publication users because of products or services in the genuine-date. That it character is crucial to have increasing customer happiness and maintaining a confident brand visualize.

SiteStaff Talk

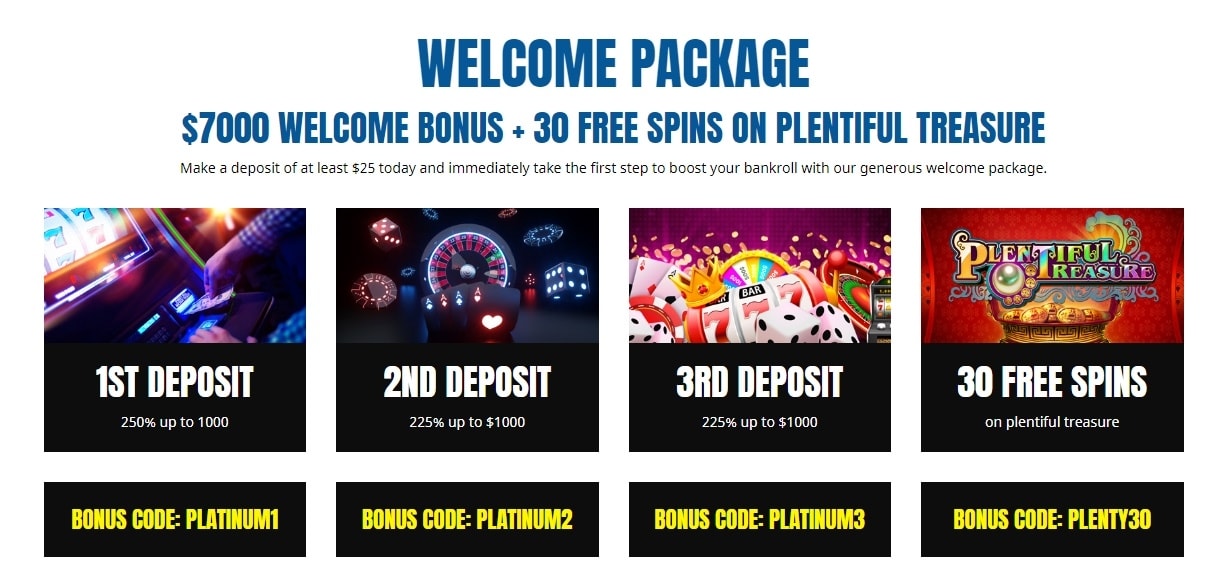

You could potentially familiarize yourself with the brand new auto mechanics, comprehend the method the greatest-paying icons performs and learn the extra online game, ahead of progressing to your real thing with confidence. The initial deposit bonus also provides an excellent one hundred% match to help you €2,100000, to your second places bringing 75% and you may 50% suits. The brand new wagering standards is 30x to possess incentive financing and you may 40x to own free revolves. This game claimed Push Gambling Best Higher Volatility Slot from the VideoSlots Honors regarding the internet casino ports the real deal currency group, and then we is also completely see why. You’ll love the new potentially huge winnings you to definitely happen from combining the brand new Party Will pay element to your Win Each other Means mechanic. Featuring an endless multiplier which is enhanced by activated reels, Bonanza Megaways try well known number-setter regarding real cash online slots having totally free spins.

Could you Let me know And this Applications to have Web based casinos Actually Shell out Away?

White Bunny Megaways are a forward thinking slot of Big style Playing that provides as much as 248,832 ways to victory. The advantage pick ability makes you dive straight into the newest totally free revolves bullet, and it advances the RTP rate of 97.24% in order to 97.72%. The newest picture is actually epic, as well as the Alice-in-wonderland-inspired motif try fun.